For investors getting nervous by the market’s rising volatility in recent weeks, high-yield dividend stocks might offer some shelter from the storms. Stocks with high dividend payouts provide a valuable offset against falling share prices. And, stocks that typically exhibit low volatility in their share price can be even more valuable for those investors with a low tolerance for risk.

One way to judge a stock’s volatility is its Beta value, which compares how much a share price has historically fluctuated, in relation to how the broader S&P 500 Index moves. Telecom giant Verizon Communications (NYSE:VZ) has a Beta value of 0.51, which makes it one of the 100 lowest-Beta stocks in the S&P 500 Index.

In addition, Verizon stock offers a hefty 4.3% dividend yield, more than double what the average stock in the S&P 500 pays today. Its high dividend yield and low stock volatility make Verizon an attractive stock for risk-averse income investors.

The Top Wireless Carrier

Verizon Communications is the largest telecommunications company in the United States based on market capitalization. It has a market capitalization of $231 billion. Its only competitor of similar size in the U.S. is fellow telecom giant AT&T Inc. (NYSE:T). Verizon’s core business is Verizon Wireless, the largest wireless carrier in the country. The company’s Wireless segment contributes approximately three-quarters of its aggregate revenue and covers approximately 298 million people and 98% of the United States.

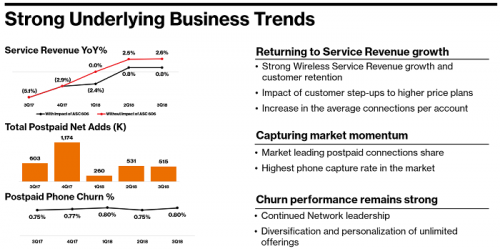

Until 2014, Verizon had only owned 55% of Verizon Wireless. But in February 2014, Verizon closed on its acquisition of the remaining 45% of the wireless business, which was held by European telecom giant Vodafone (LON:VOD). Verizon paid Vodafone a hefty sum—approximately $130 billion—for the remainder of Verizon Wireless. This was a huge amount of money, which saddled Verizon with a significant amount of debt. At the time, Verizon’s rationale was that it needed to make the deal because the future of the telecom industry was wireless service. It seems from Verizon’s strong financial performance over the past several years, that management was right. Wireless service revenue growth has accelerated over the past year.

Source: Sell-side Analyst Meeting, page 15

Verizon reported solid growth in the most recent quarter. Revenue grew 2.8% to $32.6 billion, which beat analyst estimates by $110 million. Earnings-per-share of $1.22 beat estimates by $0.03 and grew by more than 24% over the same period a year ago. Verizon’s better-than-expected financial results were driven in large part by strong performance in its core Wireless segment. Subscriber additions, net of cancellations, were 295,000 last quarter, far ahead of the 161,000 expected. Wireless segment revenue increased by 6.5%, which more than offset a decline of 3.8% in the Wireline segment. This was the sixth consecutive quarter in which Verizon had a customer churn rate of 0.8% or less.

Looking Toward The Future

Verizon has grown its earnings-per-share by approximately 5% per year over the last decade, thanks largely to the growth of the wireless business. There should be plenty of continued growth in wireless, as the smartphone boom shows no signs of ending. And, Verizon is on the cusp of some exciting new growth opportunities for the future.

Future growth will be driven by the continued strength of its Wireless segment as well as new initiatives such as the introduction of a 5G network. Verizon expects to unveil 5G service in the first half of 2019. Another growth catalyst for Verizon is the Internet of Things, or IoT, which will power connectivity outside of just smartphones and tablets. Verizon has made multiple acquisitions to boost its IoT business in recent years, including the $2.5 billion acquisition of Fleetmatics, and the $900 million acquisition of Telogis. Verizon’s IoT business generated 12% revenue growth in the most recent quarter.

Plus, as the largest wireless carrier in the U.S., 5G is a major growth catalyst for Verizon. The company has initiated pilot programs in a handful of U.S. cities, and is ramping up for a broader rollout in 2019. There is a huge opportunity for Verizon in 5G. The company stated in its 2017 annual report that 5G will allow 10 to 100 times better throughput, 10 times longer battery life and 1,000 times larger data volumes than anything offered today. Verizon’s $3.1 billion acquisition of Straight Path Communications gave it additional spectrum and a head start in 5G.

Dividends On Speed Dial

Verizon’s long-term growth potential is highly attractive. In the meantime, the company rewards shareholders with a compelling dividend. With an annualized dividend payout of $2.41 per share, Verizon stock has a dividend yield of 4.3%. Importantly, Verizon’s dividend is secure, thanks to its highly profitable business model and its satisfactory debt metrics.

Verizon is on pace for a payout ratio of approximately 54% in 2018. This is a modest dividend payout ratio which leaves plenty of room for dividend increases. Verizon has increased its dividend for 12 consecutive years and is likely to continue to pay rising dividends for the foreseeable future. Adding to the security of the dividend is a manageable amount of debt on the balance sheet. Verizon consistently operates with an interest coverage ratio exceeding 5x and is on pace for approximately 5.5x of interest coverage for 2018. In addition, Verizon has a credit rating of BBB+ from Standard & Poor’s and Baa1 from Moody’s, along with a stable outlook from all three major U.S. credit ratings agencies. Maintaining investment-grade credit ratings helps keep Verizon’s cost of debt from becoming too burdensome.

Verizon is likely to generate earnings-per-share of approximately $4.35 in fiscal 2018. Using this estimate, the company is trading at a price-to-earnings ratio of 12.9 today. This is a reasonable stock valuation. Consider that the broader S&P 500 Index has an average price-to-earnings ratio in the mid-20’s. Verizon traded at an average price-to-earnings ratio of 14 over the last decade. If the company’s price-to-earnings ratio expands to its 10-year average over the next five years, this will increase Verizon’s total returns by about 1.7% per year. The combination of 5% annual earnings growth, the 4.3% dividend yield, and 1.7% additional return through expansion of the price-to-earnings ratio, Verizon’s total expected returns are 11% per year.

Final Thoughts

The telecom industry is normally associated with slow-growth dividend stocks. While Verizon gives investors all the benefits of investing in telecom stocks—specifically, a highly profitable business model and a high dividend yield—it also offers growth potential as well. Through its investments in 5G and new technologies like the Internet of Things, Verizon is poised to continue growing earnings and dividends for many years. These qualities make Verizon an attractive stock pick for income investors.