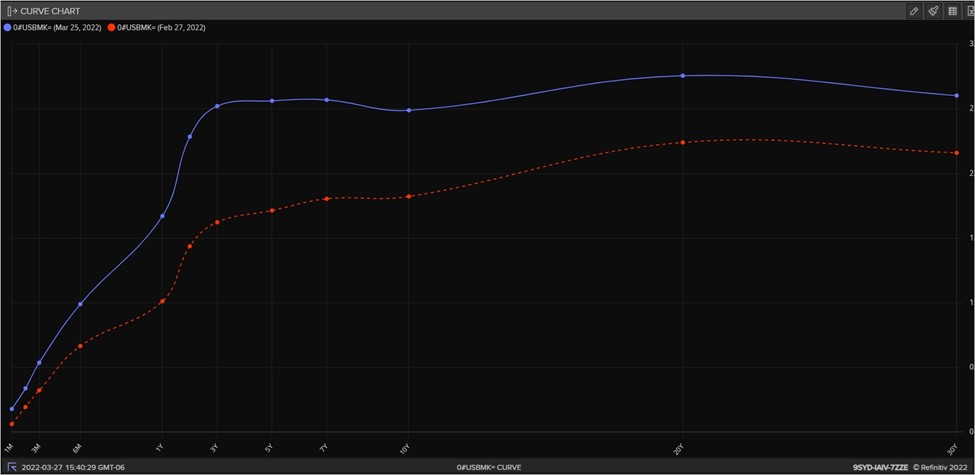

Treasury yields have been on the rise for three consecutive weeks, with the 10-year Treasury yield finishing Refinitiv Lipper’s fund-flows week ended Mar. 23, 2022, at 2.32% after hitting an almost four-year high of 2.38% the day before.

As might be expected, the General U.S. Treasury Funds (-1.01%, including ETFs) classification witnessed the largest market declines in the taxable bond fund universe, while Alternative Currency Strategy Funds (+2.06%) and Loan Participation Funds (+0.55%) posted the strongest returns.

Equity and fixed income markets remained volatile during the fund-flows week after Federal Reserve Chair Jerome Powell outlined the need to tighten monetary policy at a fast pace while speaking to the National Association for Business Economics on Monday, Mar. 21. Powell said, "If we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting, we’ll do so."

The 10-year Treasury yield jumped a combined 20 basis points (bps) on Mar. 21 and 22 to close at 2.38%—the highest closing value since May 22, 2019. However, investors continued to weigh inflationary concerns against the geopolitical uncertainty of Russia waging war against Ukraine and China’s possible growing economic ties with Russia.

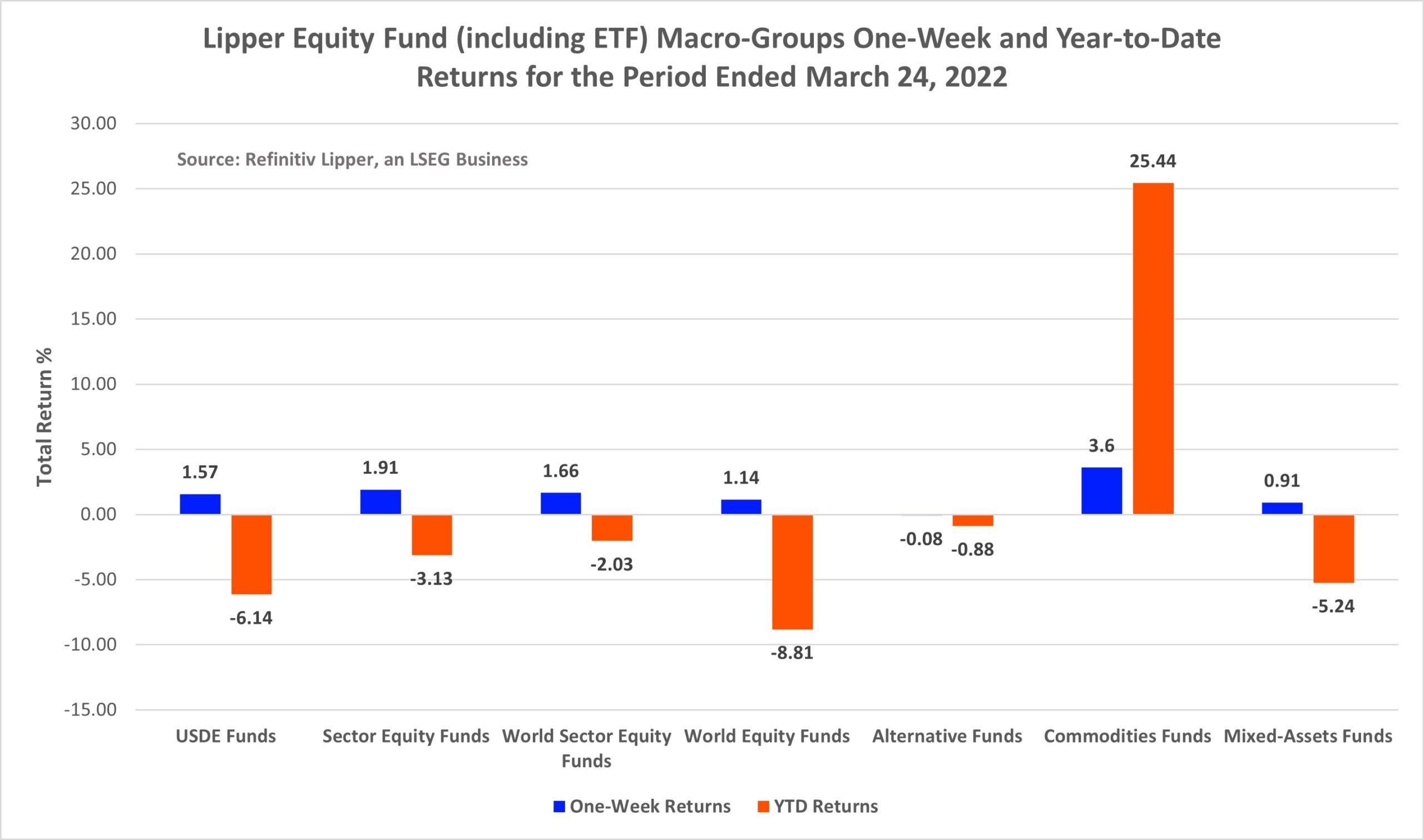

Despite wild swings in the equity market, the average equity mutual fund returned 1.38% for the Lipper performance week ended Mar. 24. The alternatives funds macro-group declining 0.08% on average for the week witnessed the largest declines of Lipper’s broad-based macro-classifications, while the commodities funds macro-group (+3.60%) experienced the strongest returns.

With inflationary concerns growing and commodity prices once again on the rise, it’s not too surprising to see Latin American Funds (+7.30%), Commodities Energy Funds (+5.43%), Natural Resources Funds (+5.39%), and Global Natural Resources Funds (+5.33%) jump to the top of the equity funds leaderboard for the week.

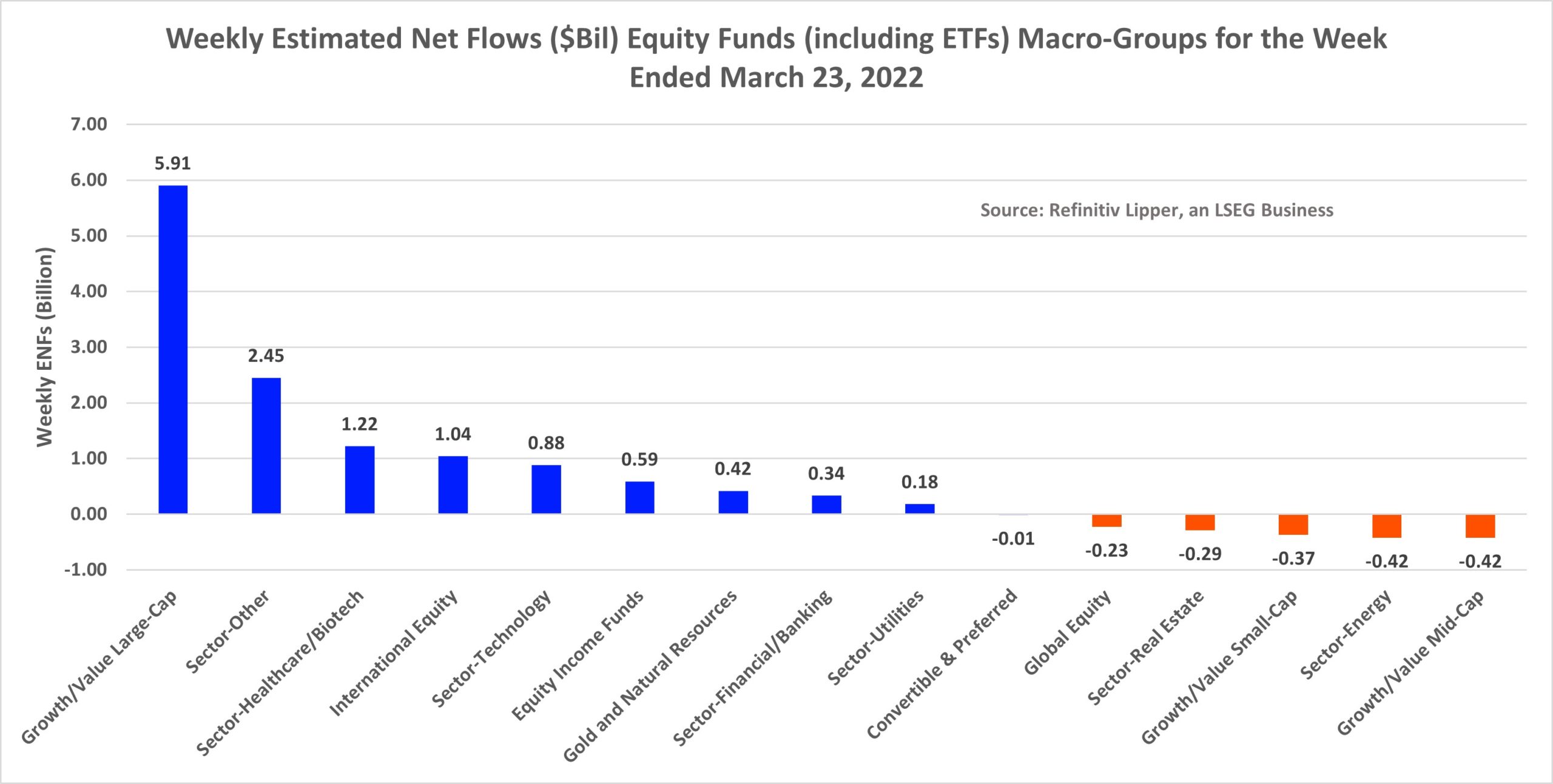

While investors padded the coffers of the commodities heavy sector-other group, injecting a net $2.5 billion for the fund-flows week, perhaps a more conservative approach to equity allocation during these confusing times catapulted large-cap funds (+$5.9 billion) to the top of the inflows chart as investors appeared to favor quality.

Both large-cap ETFs (+$5.4 billion) and large-cap conventional funds (+$493 million) took in net new money during the flow’s week. This is only the third week this year that conventional large-cap funds have attracted net new money, while large-cap ETFs have seen only three weeks of net redemptions in 2022 so far.

And while historically investors generally chose money market funds during times of equity and fixed income volatility, inflationary concerns and a decline in purchasing power have contributed to investors being net redeemers of money market funds, withdrawing $2.9 billion this week and $158.0 billion year to date.

Money market funds have only seen three weeks of net inflows this year, with two of those occurring around the first two weeks of Russia’s invasion of Ukraine. If this trend continues this would be the first year of net redemptions for money markets since 2016. Investors injected a net $356.1 billion into money market funds in 2021.

Data Source: Refinitiv Workspace

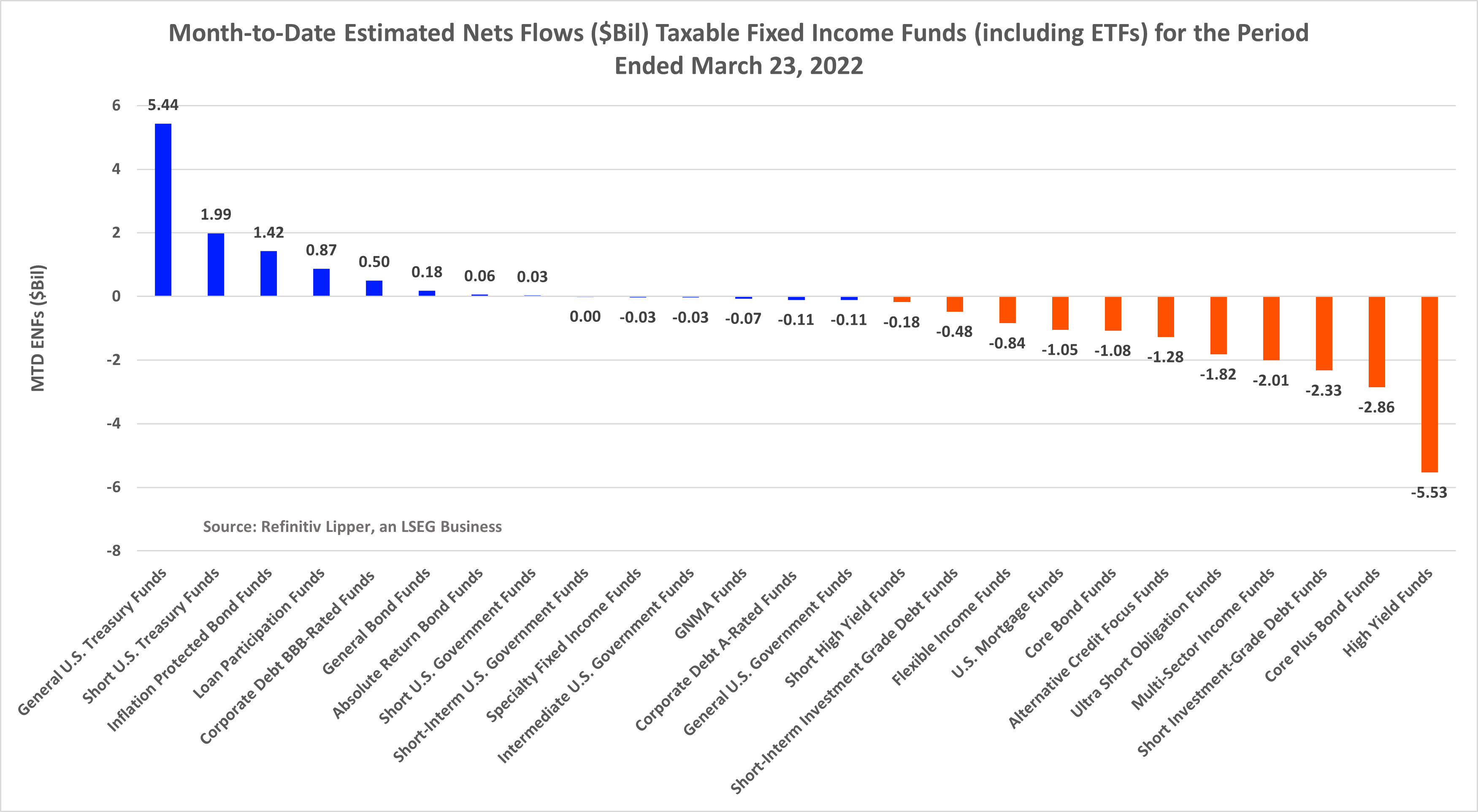

Ironically, even though we have seen an upward shift and flattening of the yield curve for March thus far, geopolitical concerns appear to be influencing investor purchases, with General U.S. Treasury Funds (+$5.4 billion, including ETFs) and Short U.S. Treasury Funds (+$2.0 billion) attracting the lion’s share of the net new money for the month despite General U.S. Treasury Funds (-4.82%) witnessing the largest month-to-date decline, followed closely by Corporate Debt A-Rated Funds (-3.33%) and Corporate Debt BBB-Rated Funds (-3.26%).

However, as we’d anticipate given the hawkish statement last week from St. Louis Federal Reserve President Jim Bullard—who called for a 50-bps hike at the most recent FOMC meeting, explaining he wants the key lending rate at 3% by year end—Inflation Protected Bond Funds and Loan Participation Funds attracted the next largest sums of net new money month to date, attracting $1.4 billion and $870 million, respectively.

So, while Fed officials are collectively much more hawkish now, investors generally understand that accommodative interest rate policy remains supportive, and rates are likely to stay relatively low.

All eyes, however, will be on the upcoming Q2 earnings season, where at least presently the underlying growth outlook appears healthy as businesses continue to reinvest and economies continue to advance post COVID-19.

Of the many unknowns, however—the longevity of the Russian war in Ukraine—its geopolitical implications, and its impact on commodities prices and availability will keep many investors on the fence.