Investing.com’s stocks of the week

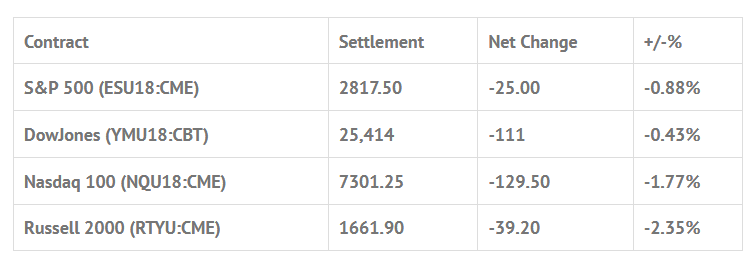

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp -0.12%, Hang Seng -0.25%, Nikkei -0.74%

- In Europe 8 out of 13 markets are trading lower: CAC -0.22%, DAX -0.26%, FTSE +0.14%

- Fair Value: S&P +0.56, NASDAQ +9.53, Dow -24.55

- Total Volume: 1.49mil ESU & 319 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Pending Home Sales Index 10:00 AM ET, Dallas Fed Mfg Survey 10:30 AM ET, and Farm Prices 3:00 PM ET.

S&P 500 Futures: Ugly Tech Friday

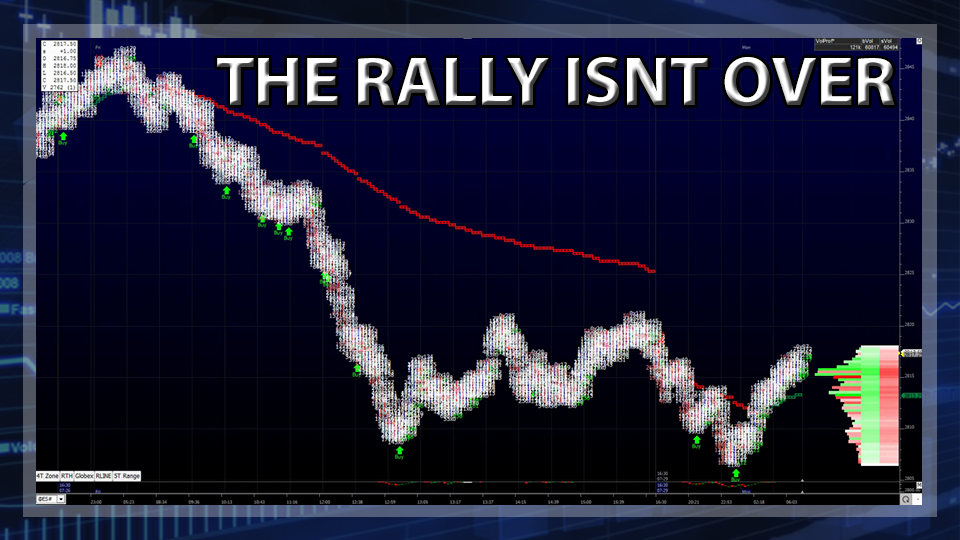

Friday, foreign markets closed mixed to lower. The overnight Globex range in the S&P 500 futures (ESU18:CME) was 2839.00 to 2847.00 with 136,000 contracts traded. The first print off the 8:30 CT bell came in at 2842.50. Initially, the futures upticked after the open, and then got hit by an early sell program, pulling the ES down to 2838.50 as AMAZON sold off, and then down to 2834.00. After that, the ES traded a series of lower highs, and then made new lows down to 2731.25 at 9:50 CT. After a bounce up to the 2834.00 level the futures sold off down to a new low at 2824.50 at 11:10 CT, then down to 2816.75 at 11:40, and then down to 2808.75.

It was one tech sell program after another.

The next move was a rally up to 2817.00, followed by a small pullback, then another rally up to the 2821.00 before selling back off down to 2812.75. After that, the ES then sold off three more times down to the 2812.50 area, and rallied up to the 2820.00 area as the MiM went from sell $220 million to sell $373 million.

The S&P futures traded 2818.25 as the final 2:45 cash imbalance reveal showed $595 million for sale, traded 2819.50 on the 3:00 cash close, and settled at 2817.50 on the 3:15 futures close, down -25.00 handles, or -0.88% on the day.

In the end, it was a combination of some sizable tech stock profit taking, and selling the GDP news. In terms of the overall tone, with the exception of the late day bounce, the ES and NQ acted very ugly. In terms of the days overall trade, the decline pushed the volume out to 1.49 million contracts, which would be considered high for being the end of July. Clearly all the bots / sell programs kicked up the volume.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.