Here is your Bonus Idea with links to the full Top Ten:

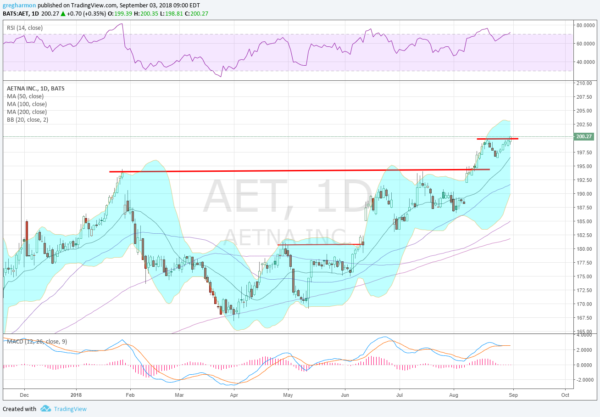

Aetna (NYSE:AET), $AET, made a high with the market in January and started to pullback. It paused as it hit the 100 day SMA and then resumed lower, finding support at the 200 day SMA in March. A bounce in April failed and it fell back to the 200 day SMA in May. But since then it has been moving higher, first breaking the April high, then testing the January high and pushing through. It ended last week with a new all-time high after a 6 day uptrend.

The RSI is bullish and rising, just barely into technically overbought territory. The MACD is flat after a pullback, and avoiding a cross down. The Bollinger Bands® are generally angled higher but flattening at the top. There is still room to move higher within them though. There is no resistance above, and a Measured Move would give a target on this leg to 210. Support lower comes at 200 and 196.60 then 194 and 192. Short interest is low at 1.5%. The company is expected to report earnings next on October 29th and will likely declare a dividend in the range of about 1% annually just before that.

Looking at the options chains shows the September monthly with very large open interest at the 185 put strike. October options have the biggest open interest at the 180 and 175 call strikes. The January options are the first that cover the next earnings report and they show massive open interest below at the 150 strike on the put side with large size also at the 180 strike and bracketed at 170 and 190. Calls are biggest at the 195 and 200 strikes but much smaller.

Trade Idea 1: Buy the stock now (over 200) with a stop at 196.

Trade Idea 2: Buy the stock now (over 200) and add a September 200/190 Put Spread ($2.30) selling the October 12 Expiry 207.50 Calls ($2.00) to pay for the protection.

Trade Idea 3: Buy the September/October 12 Expiry 205 Call Calendar ($1.70).

Trade Idea 4: Buy the January 210/220 Call Spread ($2.25) and sell the October 185 Puts ($1.00).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with eight months in the books and the long Labor Day Weekend upon us sees the equity markets are waking up tanned and rested from their summer vacation.

Elsewhere look for Gold to possibly pause in its downtrend while Crude Oil resumes the path higher. The US Dollar Index is searching for support in a pullback while US Treasuries are in broad consolidation. The Shanghai Composite and Emerging Markets are biased to the downside with the former on the cusp of new 4 year lows.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s. Their charts are now showing strength on both the daily and weekly timeframes as all end august at monthly all-time highs. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.