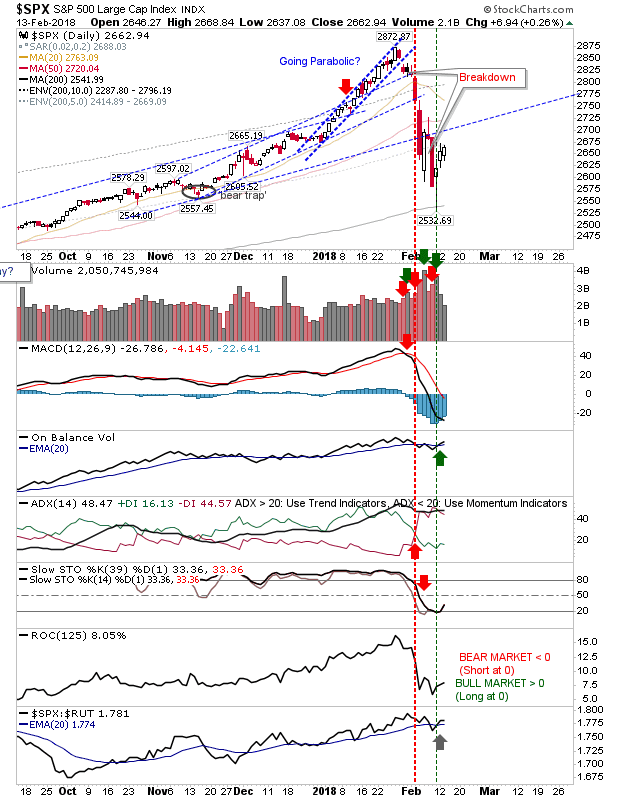

Markets continued their advance yesterday after successfully bouncing off their 200-day MAs. While indices play defense and edge small gains they are in a position to gradually attract fresh buyers.

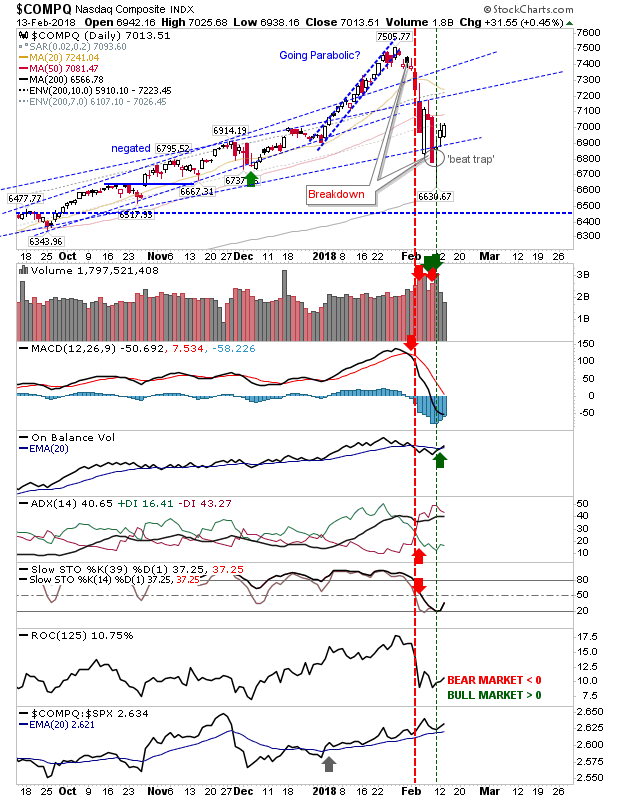

The NASDAQ edged slightly bigger gains on the day as it makes its way back to its first overhead test of its 50-day MA. Assuming the index can hold on to the recovery above channel support it will be working off a 'bear trap' - a good place to position stops. The continued relative outperformance of the NASDA! to its peers will also help.

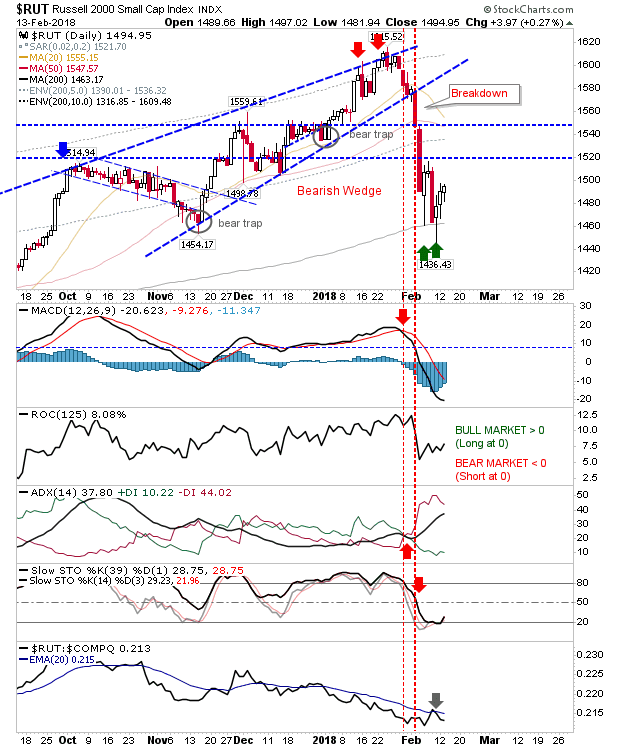

The Russell 2000 hasn't put a foot wrong since bouncing off its 200-day MA but it took another tick lower in relative performance which leaves it vulnerable should a fresh round of selling kick off.

For today, bulls will want to maintain the momentum of small, steady gains. There is plenty of lost ground to make up but there will be no shortage of patience given the big gains posted over the course of this bull market.

If the day starts weak or fails to follow through after the opening half hour, then look for a down day which could be the start of a low retest.