We're up over 28% year-to-date, while the S&P 500 (SPX) has climbed around 20%. Yet, signs are emerging that the market's rally could soon hit a wall. Key indicators, like the SPX/TLT ratio and its Relative Strength Index (RSI), have reached bearish levels that suggest the market is running out of steam.

The SPX/TLT ratio's RSI hit 76 today—well into bearish territory. Historically, when this RSI crosses above 70 (as seen by the blue dotted lines), the market has limited upside and often experiences a pullback. Ideally, we’d like to see the RSI near 30 before the 2024 election, as this has historically marked bullish setups, including in both the 2016 and 2020 elections when Trump was a candidate.

Additional Warning Signs Flashing

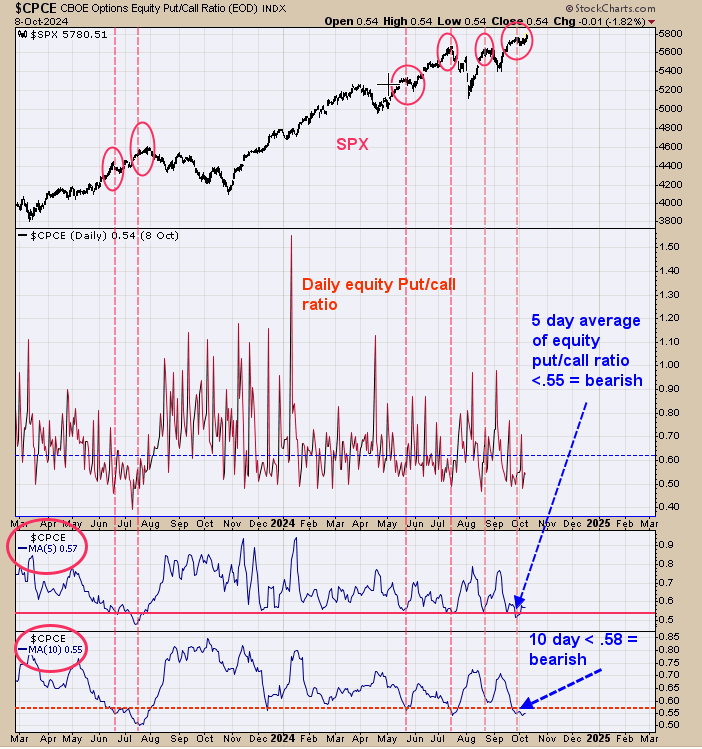

Another red flag comes from the 10-day and 5-day moving averages of the Equity Put/Call ratio. Both averages have reached levels that, in the past, have signaled stalling or declines in the SPX. These moments are highlighted by red dotted lines, underscoring the market's vulnerability.

Moreover, the weekly SPX/VIX ratio has been showing bearish divergence since July, hinting that the SPX’s upward momentum is weakening. However, with the NYSE Summation Index closing above +1000 on September 30, underlying market strength may temper any near-term correction. We anticipate that any pullback will likely be mild, with a potential market low forming later this month, well ahead of the election.

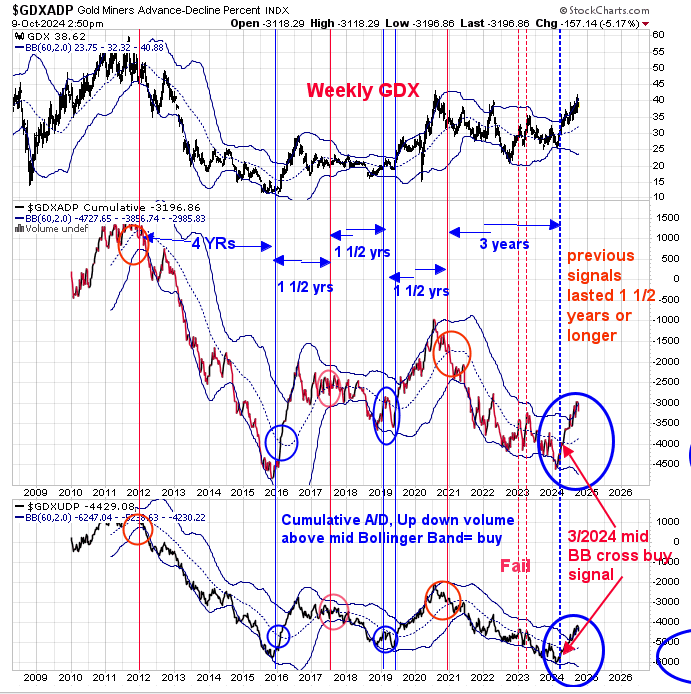

Gold Miners Showing Bullish Strength

Switching to GDX, our indicators remain bullish. The weekly GDX cumulative advance/decline line and up-down volume have stayed above their mid-Bollinger Bands since March, triggering a buy signal that historically lasts between 1.5 and 4 years. We expect this bullish trend to hold strong at least through September 2025, offering solid potential for long-term gains in the gold miners.