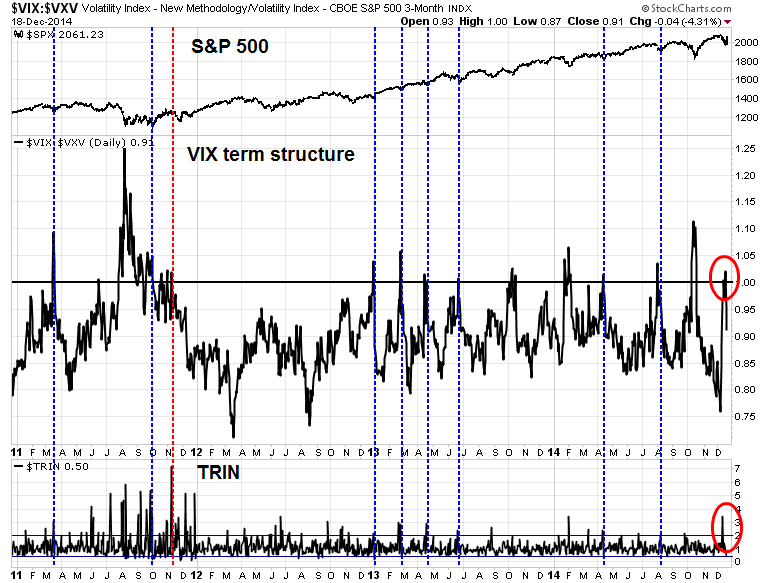

I have been calling for an oversold rally to start in the past week. Even though my calls were early, it seems that a V-shaped bottom and meltup is in process. In my last weekend post (see 2015: Bullish skies with scattered periods of volatility), I pointed to the combination of VIX term structure inversion and TRIN over 2 as a virtually certain bottom calling indicator.

The chart below shows the past instances, marked by vertical lines, when this indicator has generated buy signals. The blue lines indicate past episodes when it successfully marked a short-term bottom in the last four years and the red line shows the one time when it failed.

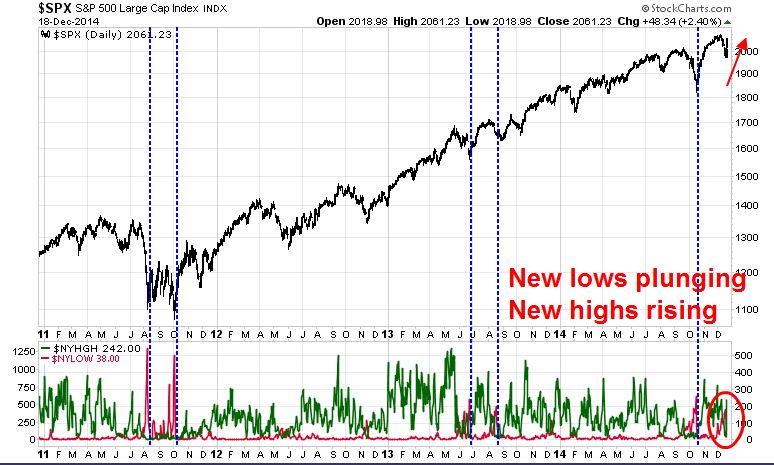

In addition, I have been watching the levels of the NYSE new 52-week highs (green) and 52-week lows (red). Most recently, the new low count has spiked to extraordinarily high levels and then retreated. I have marked with vertical lines the past occurrences of this condition in the last four years. Each of those episodes were associated with V-shaped bottoms and subsequent rallies to new highs in the SPX.

If history is any guide, we should see Santa Claus bring investors new highs in the major US equity averages, either before year-end or shortly into 2015. As the stock market has been on a tear in the past few days, it would not be surprising to see it pause and possibly stage a minor pullback. Should that happen, it would provide a good entry point for traders who have missed this powerful rally to get long.

Disclosure: Long SPXL, TNA

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.