Investing.com’s stocks of the week

Right from the open, stocks lost altitude yesterday, and value could not overpower the tech slide. Long-dated Treasuries had a climactic day of incomplete reversal on outrageous volume. Regardless of the evidence of asset price inflation, there is almost universal short-term vulnerability, and yesterday's broad-based selling spanning precious metals and commodities, confirms that. The dollar has been missing from the party though, only having reversed prior losses to close little changed on the day.

Are we seeing a trend change, or a time-limited yet powerful push lower? That depends upon the asset. In stocks, I look for the tech big names and health care to do worse than value (the VTV:QQQ ratio jumped up greatly through the week, portending the tech issues). Both silver and gold would be under pressure, and I look for the white metal to be mostly doing better overall. Oil and copper would take a breather while remaining in bull markets.

That roughly matches my very short-term idea for where the markets would trade, echoing the expressed, tweeted need to watch oil and copper turn the corner.

This is what I wrote seven hours before the U.S. open:

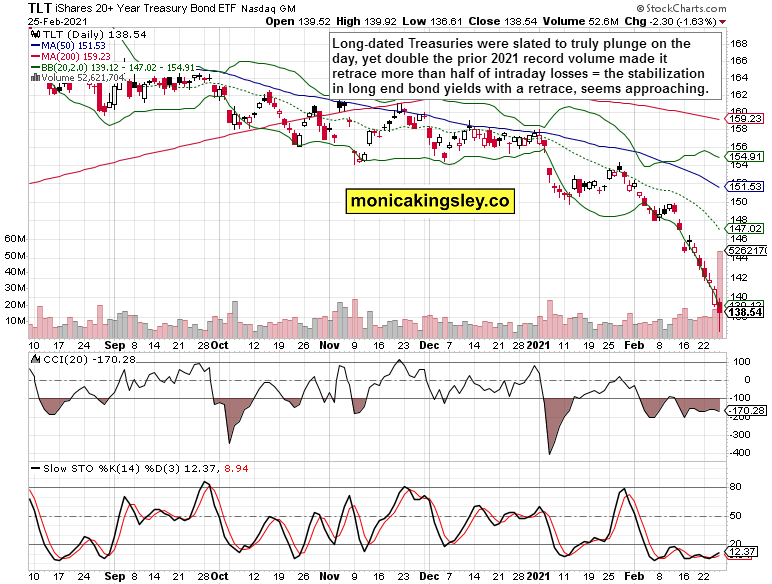

(…) As yesterday's session moved to a close, the dollar erased opening losses, and went neutral. TLT's massive volume shows that yields are likely to stabilize here for now, and even decline a bit – HYG absolutely didn't convince me. The oil-copper tandem didn't kick in yesterday. Right now, we're in a weak constellation with both silver, oil, and stocks down. Copper's modest uptick doesn't cut it. So, the outlook for the European session on Friday is more bearish than bullish for stocks really, and gold rather sideways in the coming hours.

Would we get a bounce during the U.S. session? It‘s possible to the point of likely. The damage done yesterday, though, looks to have more than a few brief sessions to run to repair. If you were to be hiding in the not too greatly performing S&P 500 sectors before the uptrend reasserts itself, you would be rather fine. The same for commodities and metals, which were solidly trending higher before – oil, platinum, copper. Look at yesterday's low platinum volume, or at the modest Freeport McMoRan decline – these charts are not broken. Meanwhile silver relegated to sideways trading (with a need to defend against the bears sternly) and silver miners taking their time.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

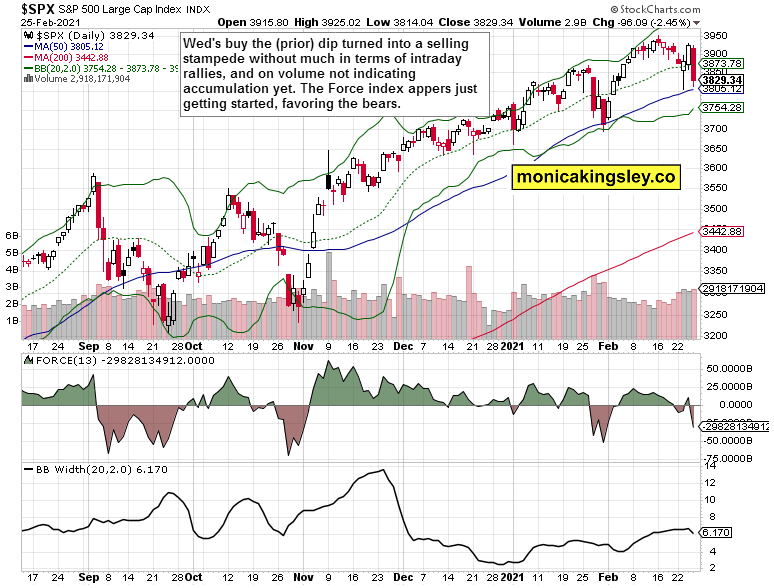

S&P 500 and Its Internals

The Force Index shows that the bears have the upper edge now, and volume coupled with price action, shows no accumulation yet. The chart is worrying for it could reach the January lows fast if the sellers get more determined.

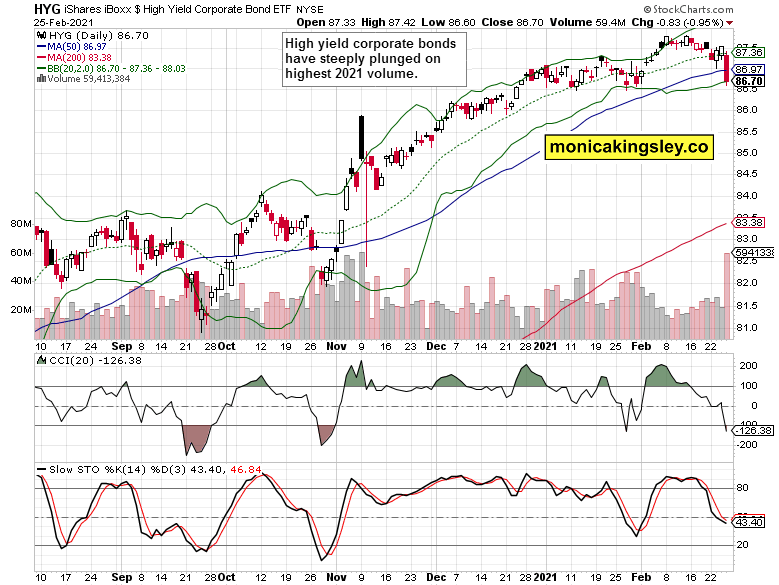

Credit Markets

High-yield corporate bonds (iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) ETF) reveal the damage suffered, underlined by the strong volume. High yields in iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) and iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD) are starting to have an effect on stocks.

Another stressed bond market chart – long-term Treasuries show a budding reversal to the upside. Given yesterday's happenings in the 10-year bond auction with the subsequent retreat from high yields since, and the dollar moving over 90.50 as we speak, the signs are in place for the TLT retracing part of the steep slide as well.

Technology

The momentum in tech (Technology Select Sector SPDR® Fund (NYSE:XLK) ETF) is with the bears as the 50-day moving average got easily pierced yesterday again. It‘s still the heavyweights that matter (roughly similar to the healthcare situation here), and the sector remains very vulnerable to further downside.

Volatility

The CBOE Volatility Index rose, but is far below the two serious autumn 2020 and the late January 2021 corrections. It even retreated on the day, regardless of the heavy S&P 500 selling. Neither the options traders are taking yesterday's move as a true game changer, even though it was (for the bond markets). Would the anticipated stock indices rebound today bring it down really substantially, spilling over into commodities too, and show that this indeed wasn‘t a turning point?

Summary

Stock bulls got a harsh reality check, and everything isn't very fine yet in the tech arena. By the shape of things thus far, today's rebound is more likely than not to turn out to be a dead cat bounce, and more short-term downside remains likely.