The DAX index is showing limited movement in the Thursday session. Currently, the DAX is at 13,001.00, down 0.10%. On the release front, German Final GDP accelerated to 0.8%, matching the forecast. German and Eurozone Manufacturing PMIs beat their estimates, with readings of 62.5 and 60.0, respectively. Later in the day, the ECB releases the minutes of its October policy meeting. On Friday, Germany releases Ifo Business Climate.

German manufacturing data continues to point upwards, and there was more good news on Thursday, as German Manufacturing PMI improved to 62.5, above the forecast of 60.4 points. This marked its highest level since 2010. Eurozone Manufacturing PMI also kept pace, climbing to 60.0, compared to an estimate of 58.3 points. Manufacturing sectors in Germany and the eurozone have been buoyed by an increase in global demand and stronger domestic consumption.

The ECB releases the minutes of the October policy meeting, and the markets will be looking for clues regarding future monetary policy. At the meeting, the ECB took the long-awaited step of tapering its asset-purchase program, announcing that monthly asset purchases would be cut from EUR 60 billion to EUR 30 billion. At the same time, the ECB extended the program to September 2018. The markets viewed this as a dovish statement, and if the minutes reinforce this view, the euro could lose ground.

With Germany in political paralysis, there are concerns whether this will affect the robust German economy. In the short-term, the economy should be able to weather the crisis, but future growth could be in jeopardy if the political deadlock continues. The euro and German stock markets have remained steady since the coalition talks fell apart last week, indicating that investors remain upbeat about the German economy.

Economic Calendar

Thursday (November 23)

- 2:00 German Final GDP. Estimate 0.8%. Actual 0.8%

- 3:30 German Flash Manufacturing PMI. Estimate 60.4. Actual 62.5

- 3:30 German Flash Services PMI. Estimate 55.2. Actual 54.9

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 58.3. Actual 60.0

- 4:00 Eurozone Flash Services PMI. Estimate 55.2. Actual 54.9

- 7:30 ECB Monetary Policy Meeting Accounts

Friday (November 24)

- 4:00 German Ifo Business Climate. Estimate 116.6

*All release times are GMT

*Key events are in bold

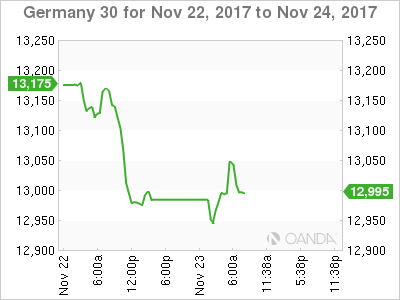

DAX, Thursday, November 23 at 8:10 EDT

Open: 12,948.50 High: 13,051.00 Low: 12,921.50 Close: 13,001.00