The DAX is showing little movement in the Monday session. Currently, the index is trading at 13,234.50, down 0.68% since the close on Monday. On the release front, eurozone Preliminary Flash GDP for the fourth quarter remained unchanged at 0.6%, matching the forecast. Later in the day, the eurozone releases Preliminary CPI for Q4, with the markets braced for a decline of 0.5%. In the US, Consumer Confidence is expected to rise to 123.2 points. As well, President Trump will deliver his State of the Union address before Congress. Wednesday will be busy. Germany releases retail sales and the eurozone will publish CPI Flash Estimate. Investors will be keeping an eye on the Federal Reserve, which releases a monetary policy statement, with the markets expecting the benchmark rate to remain unchanged at a range between 1.25%-1.50%.

Eurozone numbers for fourth quarter 2016 remain solid, led by strong German data. Eurozone Preliminary Flash GDP posted a respectable gain of 0.6%, unchanged from the Q3 release. The markets are expecting some weak consumer numbers out of Germany this week, which could hurt investor confidence and send the DAX downwards. Preliminary CPI is expected to contract 0.5%, and retail sales is forecast to decline 0.4%. If the markets prove accurate and these indicators do point downwards, investors will be hoping that they are only blips, as eurozone and German consumer numbers have generally been strong.

Investors are also concerned about the streaking euro, which could hurt exports and affect company earnings. The euro posted strong gains on Wednesday, after US Treasury Secretary Robert Mnuchin said that the US had no problem with a weak dollar. ECB policymakers were not pleased with Mnuchin’s statement, and Mario Draghi, without naming Mnuchin, said that such comments amounted to “targeting the exchange rate.” Mnuchin sheepishly backtracked, claiming his remarks had been taken out of context and that he was in favor of a stronger dollar.

Dollar Diddles for the Middle as Stocks see Red

Economic Calendar

Tuesday (January 30)

- All Day – German Preliminary CPI. Estimate -0.5%

- 5:00 Eurozone Preliminary Flash GDP. Estimate 0.6%. Actual 0.6%

- 21:00 President Trump Speaks

Wednesday (January 31)

- 2:00 German Retail Sales. Estimate -0.4%

- 3:55 German Unemployment Change. Estimate -20K

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.3%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.0%

- 5:00 Eurozone Unemployment Rate. Estimate 8.7%

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

*All release times are GMT

*Key events are in bold

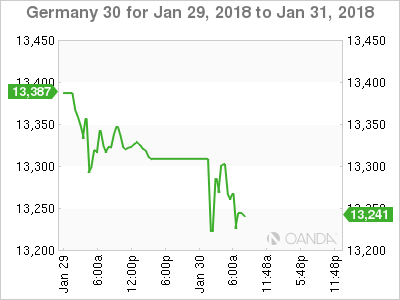

DAX, Tuesday, January 30 at 6:55 EDT

Open: 13,224.50 High: 13,311.50 Low: 13,221.50 Close: 13,234.50