The DAX is showing little movement in Thursday's session. Currently, the index is trading at 13,194.00, up 0.03% on the day.

On the release front, market estimates for German and eurozone final Manufacturing PMIs were on the money. The German release came in at 61.1, just shy of the estimate of 61.2 points. The eurozone indicator dipped to 59.6, matching the estimate. On Friday, the eurozone releases PPI and the US will publish nonfarm payrolls.

As expected, the Federal Reserve held the course on interest rate policy at its January meeting. In the rate statement, policymakers said that they expected the economy to continue to expand at a moderate pace and that the labor market would remain strong in 2018.

What was more noteworthy was that the Fed predicted that inflation would rise to its 2 percent target this year. This marks an upgrade in the inflation forecast, as the December statement said that inflation was expected to “remain somewhat below 2 percent.” Higher inflation is likely to open the door to tighter monetary policy, and the Fed appears on track for three or even four rate hikes in 2018, assuming that the US economy remains strong. This policy meeting was the last under Janet Yellen, as Jerome Powell will take over as Fed Chair on February 3. The slightly hawkish tone of the rate statement has raised the odds of a rate hike to 83% when the Fed next meets in March.

With eurozone inflation well under the ECB target of 2 percent, the ECB has some breathing room regarding its stimulus program (QE), which is scheduled to terminate in September. A stronger eurozone economy has raised speculation that the ECB could wind up QE and shift to normative policy, and perhaps even raise interest rates. However, ECB members have been cautious, trying to keep in check any market enthusiasm about a major change in policy. Last week, ECB President Mario Draghi went as far as saying that QE could be extended or increased if necessary.

Economic Calendar

Thursday (February 1)

- 3:55 German Final Manufacturing PMI. Estimate 61.2. Actual 61.1

- 4:00 Eurozone Final Manufacturing PMI. Estimate 59.6. Actual 59.6

Friday (February 2)

- 5:00 Eurozone PPI. Estimate 0.3%

- 8:30 US Nonfarm Employment Change. Estimate 181K

*All release times are GMT

*Key events are in bold

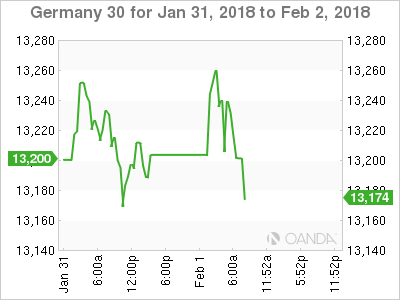

DAX, Thursday, February 1 at 7:15 EDT

Open: 13,251.50 High: 13,298.50 Low: 13,188.50 Close: 13,194.50