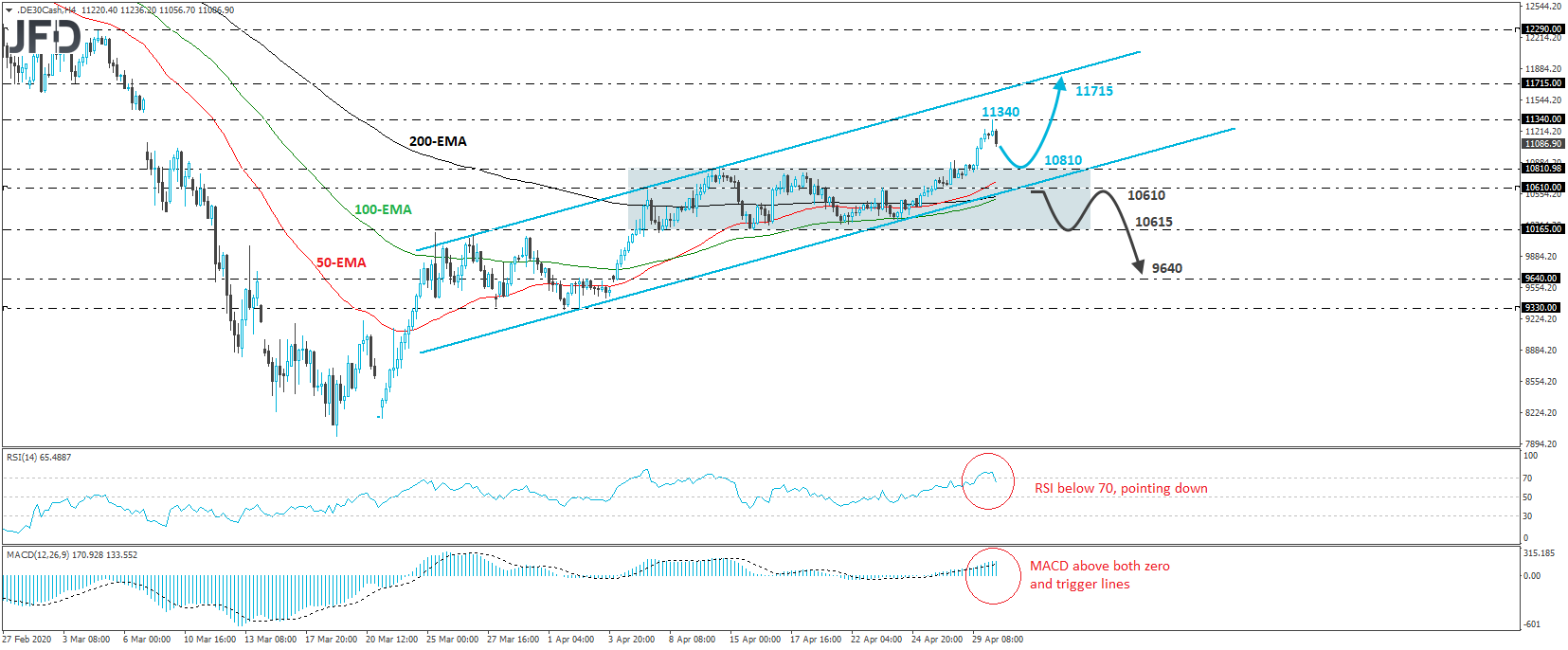

The DAX 30 cash index traded higher yesterday, clearing the upper bound of the sideways range that’s been in place since April 7th. This, combined with the fact that the index is also trading within an upside channel since March 24th, paints a positive near-term picture.

That said, the index hit resistance at 11340 today and pulled back. Thus, we would stay careful of a possible retreat before the next leg north, perhaps for the price to challenge the 10810 barrier, which is the upper bound of the aforementioned range, or the lower end of the upside channel. The bulls may take charge from near these support areas and perhaps shoot for another test at 11340. If they manage to overcome the 11340 hurdle this time around, we may see them aiming for the 11715 zone, marked by the inside swing low of March 3rd, or the upper boundary of the channel.

Shifting attention to our short-term momentum studies, we see that the RSI topped within its above-70 zone and just dipped below 70, while the MACD, although above both its zero and trigger lines, shows signs of topping as well. Both indicators detect slowing upside speed and corroborate our view for a setback before the next positive leg.

On the downside, we would like to see a clear dip below 10610 before we abandon the bullish case. Such a move would take the index below the lower bound of the channel, and also back withing the pre-discussed sideways range. In order to lean more to the bearish side though, we would like to see a dip below the key support zone of 10165. This would confirm a forthcoming lower low on the daily chart and may pave the way towards the low of April 6th, at around 9640.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

DAX Trades Within An Upside Channel

Published 04/30/2020, 07:22 AM

Updated 07/09/2023, 06:31 AM

DAX Trades Within An Upside Channel

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.