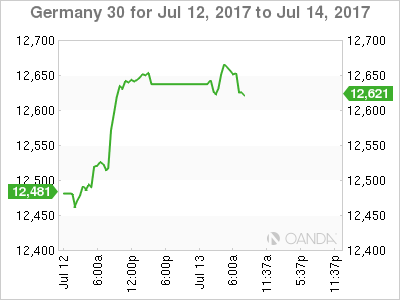

The DAX index has posted small gains in the Thursday session, as the index is up 0.26% on the day. Currently, the DAX is at 12,654.00. On the release front, German Final CPI improved to 0.2%, matching the estimate. In the US, it’s a second day of testimony from Fed Chair Janet Yellen, who will speak before the Senate Banking Committee. On Friday, the eurozone releases Trade Balance, which is expected to show a surplus of EUR 20.3 billion. The US will publish CPI and retail sales reports.

The eurozone continues to struggle with low inflation, and although Germany’s economy is in good shape, it has not been immune to chronically weak inflation levels. German Final CPI, a key gauge of consumer spending, improved to 0.2% in June, compared to -0.2% in May. CPI has managed just one reading above 0.2% in 2017, and earlier in the week, WPI came in at 0.0%, rebounding from a decline of 0.7% a month earlier. The ECB has set an inflation target of 2%, but German and eurozone inflation numbers remain well below that threshold. Although the eurozone economy has shown some improvement, there is no indication that inflation levels will move higher anytime soon, so we’re unlikely to see the cautious ECB taper its aggressive stimulus package in the coming months.

Janet Yellen’s testimony in front of a congressional committee was largely a non-event, as Yellen opted to repeat what we’ve been hearing from other Fed policy makers. Yellen reiterated that the Fed planned to raise rates “gradually”, and added that the Fed would begin trimming its balance sheet before the end of the year. The Fed chair was careful not to provide any timelines, but many analysts are circling September for a balance sheet reduction, with a rate hike to follow in December. However, despite Yellen’s assurances, the markets remain lukewarm about a rate hike before the end of the year. Investors are concerned that the US economy has slowed down in 2017 and that inflation levels have not improved, despite the Fed arguing that the factors weighing on inflation are temporary. The CME Group (NASDAQ:CME) has pegged a December rate increase at just 47%, while other forecasts are pointing to odds as low as 40%. Hints from the Fed will not suffice to bring investors on board – unless growth and inflation numbers move higher, the markets are likely to remain lukewarm about the likelihood of a third rate hike in 2017.

As if the markets don’t have enough to worry about, the Trump administration’s alleged ties with Russia are once again front-page news. This week, Washington is abuzz that Donald Trump Jr. admitted that a Russian official contacted him and offered to provide him with evidence incriminating Hillary Clinton. Predictably, the White House has attacked the media and is trying to distance itself from Trump Jr.’s meeting, but the miscue is one more example of the White House having to shift to damage control mode, rather than focus on its agenda. Trump hasn’t been able to pass health care or other legislation through Congress, even though Republicans control both the House of Representatives and the Senate. The latest dark cloud over the White House has dampened investor confidence, and it’s a safe bet that this latest crisis is not the last.

Economic Calendar

Thursday (July 13)

- 2:00 German Final CPI. Estimate 0.2%. Actual 0.2%

- 10:00 US Federal Chair Janet Yellen Testifies

Upcoming Key Events

Friday (July 14)

- 8:30 US CPI. Estimate 0.1%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Core Retail Sales. Estimate 0.2%

- 8:30 US Retail Sales. Estimate 0.1%

*All release times are EDT

*Key events are in bold

DAX, Thursday, July 13 at 7:05 EDT

Open: 12,625.50 High: 12,679.00 Low: 12,612.50 Close: 12,652.00