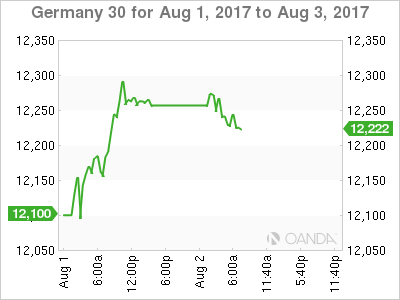

The DAX index has recorded small losses in the Wednesday session. In the European session, DAX is trading at 12,239.00, down 0.11% on the day. On the release front, Eurozone PPI declined 0.1%, matching the forecast. On Thursday, Germany and the Eurozone release Final Services PMI, and we’ll get a look at Eurozone Retail Sales.

Eurozone inflation remains well below the ECB’s target of around 2%, and there was no relief from Eurozone PPI in June. The index declined 0.1%, its second straight decline. The indicator has not managed to post a gain since January. On Tuesday, German indicators were mixed. Manufacturing PMI slowed to 58.1, missing the estimate of 58.3 points. Still, this points to steady expansion in the manufacturing sector. Unemployment Change dropped by 9 thousand, beating the estimate. Germany’s labor market remains robust, and unemployment rolls have dropped every month in 2017 but one. Meanwhile, Eurozone Preliminary Flash GDP posted a respectable gain of 0.6%, the highest gain since Q1 of 2016.

With the eurozone economy finally flexing some muscle in 2017, there has speculation that the ECB would tighten policy, and this has led to some frenzied buying of euros, much to the consternation of the ECB. At a conference of central bankers in June, ECB President Mario Draghi said that the reflationary forces could result in the bank “adjusting the parameters” of current stimulus. The comments did not appear to mark a change in ECB policy, but investors seized on the remarks and the euro soared. The ECB was caught off guard, and resorted to the unusual step of stating that the markets had misinterpreted Draghi’s comments. Given that fiasco, it’s a safe bet that the ECB will be ultra-cautious in upcoming statements in order to avoid any repeat convulsions in the markets. At the same time, as we approach the December timeline for winding up QE, the ECB would do well to act in a transparent fashion and let the markets know if the QE program will indeed wind up in December. A lack of transparency could trigger market volatility, which is precisely what ECB policymakers wish to avoid.

The US dollar has been broadly lower, and even a strong gain from US Advance GDP last week failed to stem the greenback’s slide. The first GDP report for the second quarter came in at impressive 2.6%, beating the estimate of 2.5%. This strong expansion should put to rest concerns of a second straight quarter of weak growth – Final GDP came in at just 1.4%. Still, EUR/USD soared in July, gaining 3.5%. Investors remain concerned that low inflation in the US could mean that the Fed will balk and not raise interest rates in December, despite all but promising to increase rates three times in 2017. In June, Fed Chair Janet Yellen dismissed low inflation as “transient”, but she has since changed her tune, as economists remain at a loss to explain why a red-hot economy has not translated into stronger wage growth, and hence higher inflation. The markets are skeptical about a December hike, with the odds at just 42%, according to the CME Group (NASDAQ:CME).

Economic Calendar

Wednesday (August 2)

- 5:00 Eurozone PPI. Estimate -0.1%. Actual -0.1%

- Tentative – German 10-y Bond Auction

Thursday (August 3)

- 3:55 German Final Services PMI. Estimate 53.5

- 4:00 ECB Economic Bulletin

- 4:00 Eurozone Final Services PMI. Estimate 55.4

- 5:00 Eurozone Retail Sales. Estimate 0.0%

*All release times are EDT

*Key events are in bold

DAX, Wednesday, August 2 at 6:35 EDT

Open: 12,270.00 High: 12,283 Low: 12,219.50 Close: 12,239.00