The DAX has posted small gains in the Tuesday session, as the index remains close to the symbolic 13,000 level. In the Tuesday session, the DAX is at 13,026.50, up 0.16% on the day. On the release front, German and European Manufacturing PMIs were sharp. German Flash Manufacturing PMI ticked lower to 60.5, beating the estimate of 60.1 points. Eurozone Manufacturing PMI improved to 58.6, easily beating the estimate of 57.9 points. Service sector numbers did not keep pace, as German and Eurozone Services PMIs both missed their estimates. On Wednesday, Germany releases Ifo Business Climate.

The Catalan crisis continues, and with the central and Catalan governments entrenched in their positions, the worst may be yet to come. On Saturday, the central government said it was imposing direct rule, invoking Article 155 of the Spanish Constitution. However, there is plenty of uncertainty, as this clause has never been used. Madrid has said it will depose Catalan President Carles Puigemont, take over the media and hold new elections for the region. Unsurprisingly, the Catalan government has condemned this latest salvo and has called for “massive civil disobdience”. Developments are unfolding daily, and investors are nervously watching the trouble in Spain, the eurozone’s fourth largest economy. The European Union has refused to intervene, calling the crisis an internal matter. So far, the woes in Catalonia has not affected the euro.

The eurozone economy has been performing well, with much of the credit going to a robust manufacturing sector in Germany and the eurozone. This was underscored on Tuesday, as manufacturing PMIs were strong and continue to point to expansion. The manufacturing sector remains solid, as global demand for European exports remains strong and consumer spending has been steady. German and European Services PMIs both missed their estimates, but still indicated expansion in the services sector.

Economic Calendar

Tuesday (October 24)

- 3:30 German Flash Manufacturing PMI. Estimate 60.1. Actual 60.5

- 3:30 German Flash Services PMI. Estimate 55.5. Actual 55.2

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 57.9. Actual 58.6

- 4:00 Eurozone Flash Services PMI. Estimate 55.7. Actual 54.9

Wednesday (October 25)

- 4:00 German Ifo Business Climate. Estimate 115.3

- Tentative – German 10-y Bond Auction

*All release times are GMT

*Key events are in bold

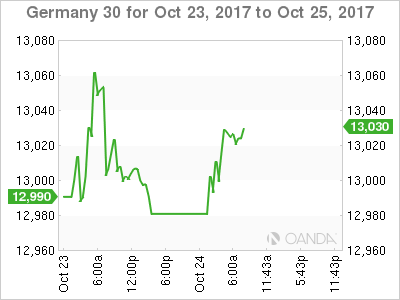

DAX, Tuesday, October 24 at 7:05 EDT

Open: 12,994.50 High: 13,036.00 Low: 12,984.50 Close: 13,026.50