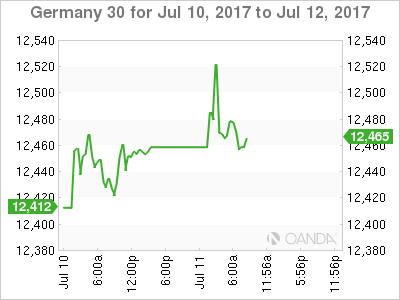

The DAX index has inched higher in the Tuesday session, as the index is up 0.20% on the day. Currently, the DAX is at 12,468.00. On the release front, there are no eurozone or German releases. On Wednesday, Germany releases WPI and the Eurozone publishes Industrial Production. In the US, Federal Reserve Chair Janet Yellen will testify before the House Financial Services Committee.

The German economy has looked solid in 2017, buoyed by strong consumer spending as well as an increased demand for German products, notably machinery. The manufacturing sector continues to expand, and Industrial Production improved to 1.2% in May, crushing the forecast of 0.2%. A strong export sector has led to an improved trade balance, and the trade surplus climbed to EUR 20.3 billion in May, which was the second highest surplus this year.

The IMF has upgraded its forecast for the German growth to 1.8 percent in 2017, up from its estimate of 1.6 percent in April. Other eurozone members are not enjoying the same fiscal stability, and the question of the fiscal stance of the eurozone as a whole was a key topic as eurozone finance ministers met in Brussels on Monday. Germany has opposed attempts to define the bloc’s fiscal stance as expansionary, and at the Monday meeting, the finance ministers agreed to aim for a”broadly neutral” stance. The European Commission wants to see Germany divert more resources to investment and public spending, given that the country is enjoying high growth.

Last week’s US employment numbers were a mixed bag. Nonfarm Payrolls rebounded in June, climbing to 222 thousand. This easily beat the estimate of 175 thousand and marked a 4-month high. However, wage growth remained stuck at 0.2%, shy of the forecast of 0.3%. Weak wage growth has remained soft throughout the first half of 2017, which is somewhat puzzling, as the labor market remains extremely tight, with an unemployment rate of 4.4%. As well, there are widespread reports of a lack of qualified workers, but this hasn’t translated into higher wages.

The markets reacted positively to the solid Nonfarm Payrolls report, but there expectations of a third rate hike in 2017 remain lukewarm. A rate increase in September is very unlikely, with the odds pegged at just 13%, according to the CME Group (NASDAQ:CME). As for December, the likelihood of a rate hike is 50%, so the markets will need plenty of convincing that the Fed plans to make a move.

What factors will raise the odds of a rate increase? First, second quarter growth will have to improve, after a weak performance in the first quarter, in which GDP rose just 1.4%. Second, stronger inflation levels would boost speculation of a rate hike. Currently, inflation is well below the Fed’s target of 2%, and although Janet Yellen recently stated that the factors weighing on inflation were temporary, investors aren’t convinced. Third, the Fed has outlined plans to reduce its bloated balance sheet, but has avoided providing any specifics. If the Fed started to lower the balance sheet in September, such a move would mark a vote of confidence in the economy and raise speculation of a rate hike to follow in December.

Economic Calendar

Tuesday (July 11)

- There are no German or Eurozone events

Upcoming Key Events

Wednesday (July 12)

- 2:00 German WPI. Estimate 0.2%

- 5:00 Eurozone Industrial Production. Estimate 1.0%

- Tentative – German 10-y Bond Auction

- 10:00 US Fed Chair Janet Yellen Testifies

*All release times are EDT

*Key events are in bold

DAX, Tuesday, July 11 at 8:05 EDT

Open: 12,479.50 High: 12,538.50 Low: 12,443.00 Close: 12,468.00