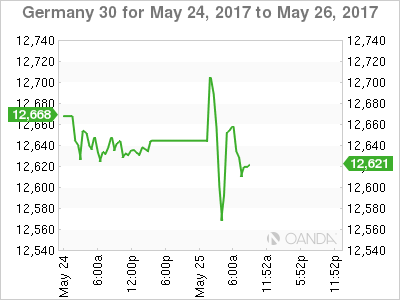

The DAX index continues to have a quiet week. The lack of movement continues on Thursday, with no German or eurozone indicators on the schedule. German banks are closed for Ascension Day, so we can expect an uneventful day from the stock markets. Currently, the DAX is trading at 12,613.75 points. The markets will be keeping a close eye on OPEC, as members are holding a meeting in Vienna. If there are any dramatic announces from the summit, fluctuations in oil prices could have a strong effect on global stock markets. On Friday, finance ministers from the G-7 nations meet in Sicily. On Friday, the US will release revised GDP for the first quarter, which is expected at 0.9%, compared to the initial GDP release, which came in at 0.7%.

German business confidence hit a record high in May. The Ifo Business Climate Index improved to 114.6, its highest level since Germany was reunified in 1991. The election of Emmanuel Macron as the French president has boosted business confidence, as the German corporate sector is optimistic that Berlin and Paris can work together to improve the eurozone economy. France is Germany’s second largest trading partner and Macron underscored the importance he attaches to Franco-Germans relation when he visited German chancellor Angela Merkel within days of winning the presidency. The Brexit vote and Donald Trump’s “America first” agenda present serious challenges to the EU, and Merkel and Macron will have no problem seeing eye-to-eye in their desire to deepen European integration.

The Federal minutes were a disappointment, as the minutes conveyed a less hawkish tone than the markets had expected. Policymakers were careful in their message, saying that a rate hike was coming “soon”. To disappointed markets, this sounded like a “definite maybe”. Does that mean a move at the June policy meeting? The markets believe so, as Fed funds futures for a June hike remained at 78% after the minutes were released. At the same time, the Fed has given itself some wiggle room, and could opt to delay a hike until the second quarter if inflation or consumer indicators take an unexpected nosedive.

The minutes stated that policymakers wanted to see additional evidence that the recent slowdown in the economy was temporary before raising rates. As for additional hikes in 2017, the markets remain skeptical. The odds for a September rate stand at just 37%. This pessimism is a result of a weak performance from the US economy in Q1, as well as doubts that President Trump, who is facing congressional investigations over his connections with the Russian government, will be able to pass his agenda of cutting taxes and government spending. Gone are the heady days at the end of 2016, when a red-hot US economy had analysts predicting four rate hikes in 2017. At the same time, a strong improvement in economic data could quickly change the cautious tone of the Fed and revive discussion of four rate hikes this year.

The US dollar struggles post Fed minutes

Earlier in the week, the White House presented President Trump’s 2018 budget proposal to lawmakers in Congress. Trump has promised to slash government spending, and much of the funds for the budget would come from huge cuts to the Medicaid health program and food stamps. The budget proposes slashing more than $600 billion from Medicaid and over $192 billion from food stamps over a decade. Trump has promised to balance the budget within 10 years, claiming this can be achieved through tax cuts and annual growth of 3 percent. However, experts are at odds as to whether the economy can reach and maintain such levels of growth, which is much higher than current economic expansion. The budget proposal is unlikely to remain in its present form for very long on Capitol Hill. Democrats will want nothing to do with it, and Republicans will not want to make drastic cuts to federal programs that will incur the wrath of voters. Still, the Trump administration, which has been in damage-control mode for weeks over the firing of FBI director James Comey, can point to the budget as a step forward in trying to implement Trump’s pro-business agenda.

Economic Calendar

Thursday (May 25)

- There are no German or Eurozone events

- All Day – OPEC meetings

Friday (May 26)

- 8:30 US Preliminary GDP. Estimate 0.9%

*All release times are EDT

*Key events are in bold

DAX, Thursday, May 25 at 8:20 EDT

Open: 12,687.75 High: 12,697 Low: 12,541.50 Close: 12,613.75