The DAX has started the week with slight losses. In the Monday session, the index is at 13,205.50, down 0.30% on the day. On the release front, there is only one indicator, as trade surplus climbed to EUR 22.5 billion, edging above the estimate of EUR 22.4 billion. US markets are closed for Martin Luther King Day.

German stock markets jumped at the start of the year, but has since steadied. The DAX failed to gain ground on Friday, despite positive news out of Germany on the political front. After months of coalition negotiations, there was major progress to report, as Angela Merkel’s conservative bloc and the Social Democrats have agreed on a coalition blueprint. This ends months of political uncertainty,which has eroded Merkel’s standing and also sidelined Germany on issues such as Brexit and political reform in the eurozone. Still, the talks are only in the preliminary stage, and further negotiations will be continuing in the coming weeks. Any coalition deal must be approved by all members of the Social Democrats camp, and this could present a challenge for party head Martin Shulz. The draft which Shulz and Merkel hammered out calls for an annual limit of 220,000 immigrants, and many Social Democrats oppose any cap on immigration. News of the breakthrough sent the euro higher on Friday, and if the agreement is ratified, the DAX could post strong gains.

An improving eurozone economy has raised speculation that the ECB could wind up its massive stimulus program in September, and that move could be followed by an interest rate hike. The last time the ECB raised rates was back in 2011, so even a hint at such a move could send European stock markets sharply higher. The ECB minutes, published last week, have increased sentiment that we could see tighter policy in 2018. In the minutes, policymakers said that risks to the current outlook were to the upside, which could necessitate a gradual shift in guidance in the next few months. As for the eurozone, the minutes stated that the economy was displaying “continued robust and increasingly self-sustaining economic expansion”.

Economic Calendar

Monday (January 13)

- 5:00 Eurozone Trade Balance. Estimate 22.4B

Tuesday (January 16)

*All release times are GMT

*Key events are in bold

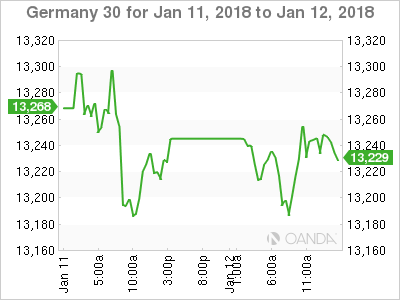

DAX, Monday, January 15 at 7:45 EDT

Open: 13,242.50 High: 13,245.50 Low: 13,170.00 Close: 13,205.50