The DAX index has moved higher in the Monday session. In the European session, DAX is trading at 12,196.00, up 0.25% on the day. On the release front, German Retail Sales climbed 1.1%, easily beating the estimate of 0.1%. Eurozone CPI Flash Estimate remained unchanged at 1.3%, matching the forecast. On Tuesday, the eurozone releases Preliminary Flash GDP, with an estimate of 0.6%.

The robust German economy continues to impress, and there was positive news on Monday, as retail sales climbed 1.1% in June. This marked the strongest gain since February. Last week, GfK German Consumer Climate strengthened for a fourth straight month, as the German consumer is optimistic about economic conditions and this has translated into strong spending. However, the fly in the ointment remains inflation, which is stuck at low levels. The lack of inflation is a pressing concern for ECB policymakers, and there is little chance that the bank will end its quantitative easing program before December, if inflation levels don’t move upwards. German policymakers would like Brussels to tighten policy, but the ECB has to worry about other eurozone members, whose economies are not as strong as Germany. If the eurozone economy continues to improve in the third quarter, the ECB could send out some cautious hints about plans to tighten policy, which would send the euro to higher levels.

It’s become an all-too-familiar pattern out of Washington – trouble for the White House has soured investor appetite and weighed on global stock markets. It was déjà vu on Friday, as President’s struggling healthcare bill gasped its final breath as the bill was defeated in the Senate after three Republican lawmakers joined the Democrats and voted against the bill. This is another setback for President Trump, who has been unable to get Congress to pass any significant legislation, despite the Republicans controlling both the House and the Senate. Trump will now be able to focus on other issues such as tax reform, but investors are skeptical as to whether the President will have the support he needs in Congress to pass major legislation. The euro climbed to 1.7777 on Friday, its highest level since January 2015. The currency’s gains weighed on the DAX, which lost ground but managed to recover before the end of the Friday session.

Economic Calendar

Monday (July 31)

- 2:00 German Retail Sales. Estimate 0.1%. Actual 1.1%

- 5:00 Eurozone CPI Flash Estimate. 1.3%. Actual 1.3%

- 5:00 Eurozone Core CPI Flash Estimate. 1.3%. Actual 1.3%

- 5:00 Eurozone Unemployment Rate. Estimate 9.2%. Actual 9.1%

Tuesday (August 1)

- 5:00 Eurozone Preliminary Flash GDP. Estimate 0.6%

*All release times are EDT

*Key events are in bold

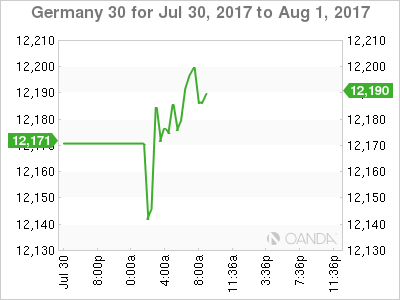

DAX, Monday, July 31 at 8:00 EDT

Open: 12,139.50 High: 12,212.50 Low: 12,139.50 Close: 12,196.00