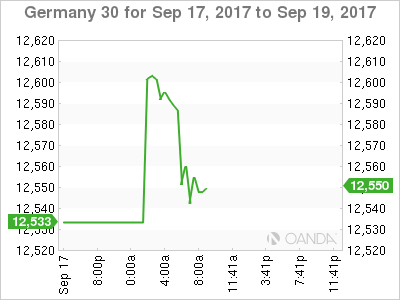

The DAX index has posted slight gains in the Monday session. Currently, the DAX is trading at 12,552.00, up 0.30% on the day. On the release front, Eurozone Final CPI improved to 1.5%, matching the forecast. On Tuesday, Germany releases ZEW Economic Sentiment, which is expected to improve to 12.3 points.

With less than a week to go before the German federal election, Angela Merkel is widely expected to win her fourth term as prime minister. Merkel’s CDU conservative party has a 14 percent lead over the center-left SPD, its current coalition partner. Another option for Merkel is the FDP, but the latter has insisted on receiving the finance ministry, and has also taken a hard line on immigration which Merkel may not be comfortable with. Germany’s position in Europe will be even more dominant when Britain leaves the European Union, which may some members of the club uneasy.

French President Emmanuel Macron, a staunch supporter of a unified Europe, is hoping to continue working with Merkel and reform the eurozone. Macron’s proposal includes a eurozone finance minister who would be in charge of a eurozone budget. Macron’s call for greater cooperation is linked to Britain’s exit from the EU, which could lead to divisions among the remaining 27 members in the bloc. However, the French ambitious plan will need Germany’s support before it can become a reality. Will Germany embrace the idea? Angela Merkel has indicated that she is open to the idea, but Jean-Claude Juckner, head of the European Commission, came out against the plan last week. Juckner said he favored a finance minister for the EU but was against a separate eurozone budget and finance minister. Even if the plan is not adopted, we can expect a Macron-Merkel alliance to take steps which will strengthen Franco-German ties and further unify the eurozone.

Economic Calendar

Monday (September 18)

- 5:00 Eurozone Final CPI. Estimate 1.5%. Actual 1.5%

- 5:00 Eurozone Final Core CPI. Estimate 1.2%. Actual 1.2%

- 6:00 German Deutsche Bundesbank Monthly Report

Tuesday (September 19)

- 4:00 Eurozone Current Account. Estimate 22.3B

- 5:00 German ZEW Economic Sentiment. Estimate 12.3

- 5:00 Eurozone ZEW Economic Sentiment. Estimate 32.4

*All release times are EDT

*Key events are in bold

DAX, Monday, September 18 at 8:20 EDT

Open: 12,601.25 High: 12,615.00 Low: 12,536.00 Close: 12,552.00