The DAX index has started the week in subdued form. In the Monday session, the index is trading at 12,464.00 up 0.10% since the Friday close. On the release front, the eurozone current account surplus narrowed to EUR 29.9 billion, short of the estimate of EUR 30.5 billion. US markets are closed for Presidents’ Day. On Tuesday, Germany releases ZEW Economic Sentiment and the eurozone will publish releases Consumer Confidence.

The recent correction in global stock markets has sent the DAX lower, with the index losing 5.9% in February. However, the index rebounded last week, posting a winning week for the first time since mid-January. Strong corporate earnings in Europe last week boosted European stock markets. The US recently passed massive corporate and individual tax reform, worth $1.5 trillion. This could significantly boost earnings in the first quarter of 2018 for European companies which have major operations in the US, such as banking giant Deutsche Bank (DE:DBKGn).

The recent turbulence in the global stock markets has triggered strong volatility in the currency markets, and ECB President Mario Draghi recently stated that the ECB was concerned about the euro’s sharp fluctuations. Last week, Draghi weighed in on Bitcoin, a cryptocurrency which has seen wild fluctuations in recent months. There are growing calls for regulation of these currencies, and central banks could play a key role in such regulation. However, Draghi poured cold water on any ECB involvement, saying that it was not the ECB’s responsibility to ban or regulate Bitcoin. Draghi added that the ECB was exploring the use of blockchain, a digital technology to monitor bitcoin transactions.

Economic Calendar

Monday (February 19)

- 4:00 Eurozone Current Account. Estimate 30.5B. Actual 29.9B

- All Day – Eurogroup Meetings

- 6:00 German Buba Monthly Report

Tuesday (February 20)

- 5:00 German ZEW Economic Sentiment. Estimate 16.5

- 5:00 Eurozone ZEW Economic Sentiment. Estimate 28.4

- 10:00 Eurozone Consumer Confidence. Estimate 1

*All release times are EST

*Key events are in bold

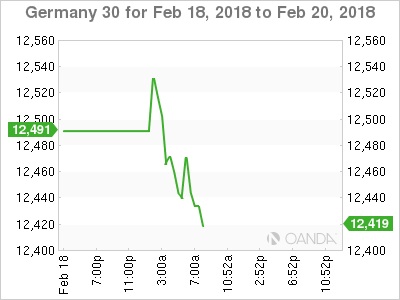

DAX, Monday, February 19 at 6:55 EDT

Open: 12,451.96 High: 12,512.00 Low: 12,426.50 Close: 12,464.00