The DAX index has started the week with gains. Currently, the DAX is at 13,101.50, up 0.25% on the day. On the release front, there are no eurozone or German events on the schedule.

The ECB changed directions and chopped its asset purchases at the November rate meeting, so analysts were eager to read the details of that meeting. The minutes, published on Thursday, stated that there was “broad agreement” among policymakers that further stimulus was still needed to boost inflation towards the ECB’s target of close to 2 percent. The minutes noted that some policymakers wanted the ECB to announce an end date to the asset purchases, but in the end, members decided to extend the program by 9 months, to September 2018.

The DAX continues to hover at high levels, buoyed by a robust German economy. The week ended on a high note, as German Ifo Business Climate in November set another record high. The indicator climbed to 117.5, above the estimate of 116.6 points. On Thursday, Final GDP in the third quarter accelerated to 0.8%, its strongest quarter since 2014. Manufacturing PMI surged to 62.5, pointing to strong expansion in the manufacturing sector. On the political front, there are renewed hopes that another election can be avoided, as the SPD (socialist democrats) have reluctantly agreed to hold coalition talks with Merkel’s conservative bloc. The SPD was the junior partner in the previous government, and is expected to come with a shopping list if it agrees to a “grand” coalition. This could mean more government spending and no cap on asylum seekers. The euro has not lost a stride since the political crisis, and on Friday, the currency pushed above 1.19 for the first time since late September.

Economic Calendar

Monday (November 27)

- There are no German or Eurozone events

Tuesday (November 28)

- 2:00 German Import Prices. Estimate 0.4%

- 4:00 Eurozone M3 Money Supply. Estimate 5.1%

- 4:00 Eurozone Private Loans. Estimate 2.8%

- 7:00 German GfK Consumer Climate. Estimate 10.8

*All release times are GMT

*Key events are in bold

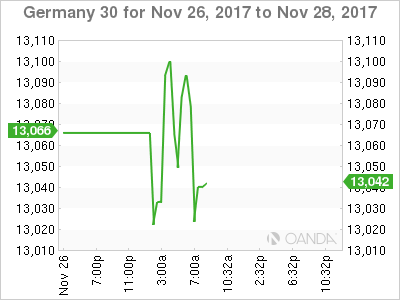

DAX, Monday, November 27 at 6:30 EDT

Open: 13,037.50 High: 13,119.50 Low: 13,003.25 Close: 13,101.50