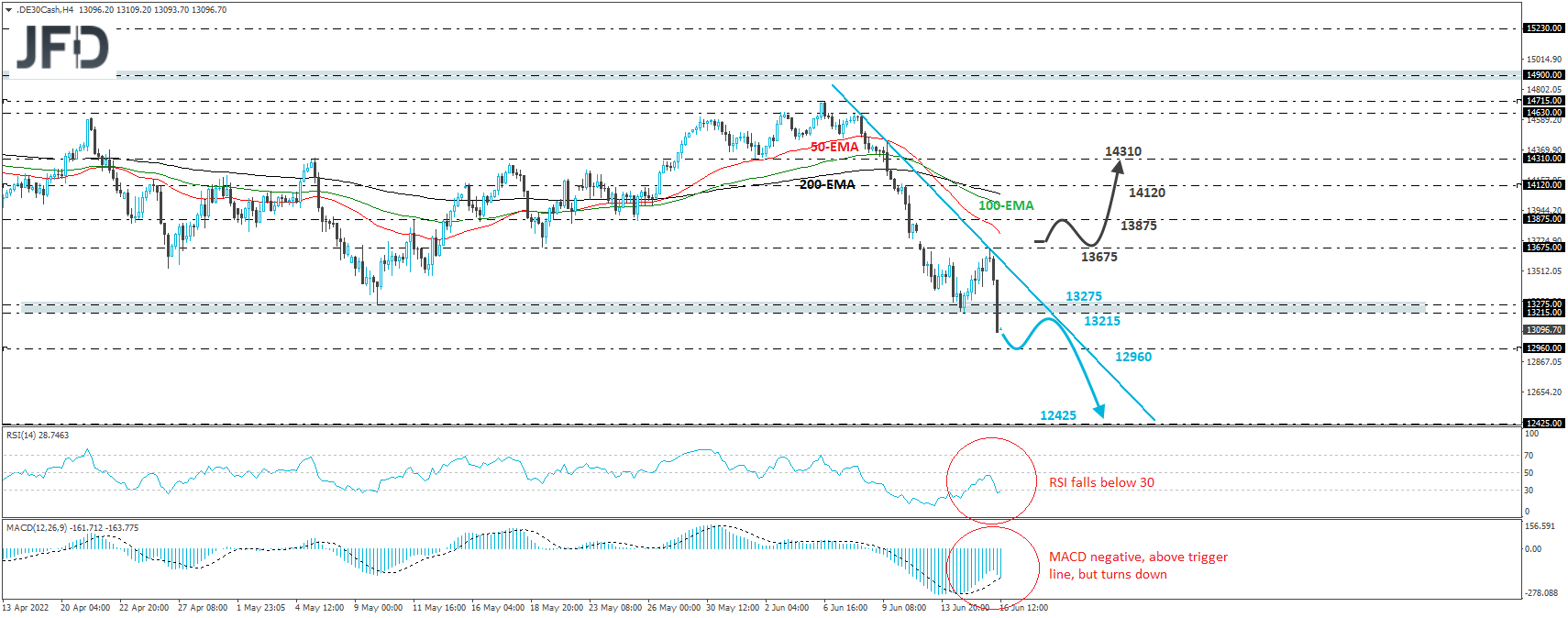

The German DAX cash index tumbled on Thursday, falling below the key support zone of 13215/75, defined by the lows of Jun. 14 and May 10, respectively. This confirmed a forthcoming lower low and, combined with the fact that it is trading below the downside resistance line taken from the high of Jun. 8, keeps the near-term picture negative.

In our view, the dip below 13215 may now allow the bears to challenge the 12960 zone, marked by the low of Mar. 9, from where they may decide to take a break. This may allow a short-term bounce, but as long as it stays below the 13215 barrier, we would see decent chances for another leg south and a break below 12960. Such a move could carry larger bearish implications and may see scope for extensions towards the 12425 territory, defined as a support by the low of Mar. 7.

Shifting attention to our short-term oscillators, we see that the RSI fell below its 30 line, while the MACD, albeit above its trigger line, runs well within its negative zone and appears ready to fall back below the trigger. Both indicators suggest that the index has started to gain downside speed again, adding to the notion of further declines in this index.

On the upside, we would like to see a clear break above 13675 before we abandon the bearish case. That barrier is marked by the high of Jun. 16, and thus, its break would confirm a forthcoming higher high. The index will also be well above the aforementioned downside line and may initially challenge the 13875 zone, marked by the inside swing low of May 25 at 13875.

If the bulls don’t stop there, we could see them climbing to the 14120 zone or even to the 14310 territories, marked by the inside swing low of Jun. 1.