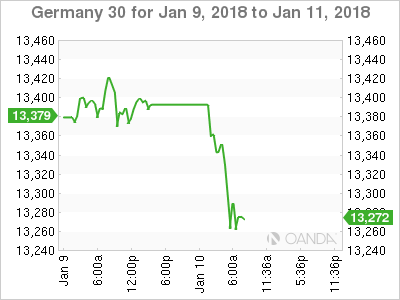

The DAX has posted considerable losses in the Wednesday session. Currently, the index is at 13,291.50, down 0.71% on the day. On the release front, there are no German or eurozone indicators. On Thursday, the eurozone releases Industrial Production and the ECB will publish the minutes of the December policy meeting.

Stronger growth in the Eurozone has also led to a steady decline in unemployment over the course of 2017. In December, the reading dropped to 8.7%. This marked its lowest level since March 2009, when the rate stood at 8.5%. This is yet another indication of the impressive rebound in the eurozone economy, as growth has been steady and the employment picture has improved. Retail Sales, the primary gauge of consumer spending, posted a strong gain of 1.5% in December, after a decline of 1.1% in November. The DAX has received a boost from the strong numbers, and has gained 2.2% since the New Year. If the eurozone economy continues to improve, the DAX rally should continue.

World stock markets have been pointing upwards early in the New Year, and the DAX has also looked sharp in January. Led by a robust German economy, the eurozone is on track for a strong fourth quarter. Inflation has also moved higher, although the ECB is unlikely to reconsider its current stimulus program, which ends in September. One area of concern is the political vacuum in Germany. President Angela Merkel is running a caretaker government, as she has been unable to form a coalition, following the September elections. Merkel is now looking at the Social Democrats to help her make a new government, and preliminary talks are scheduled to begin on Sunday. The negotiations are moving slowly, and are likely to continue for several more months.

Economic Calendar

Wednesday (January 10)

- Tentative – German 10-year Bond Auction

Thursday (January 11)

- 5:00 Eurozone Industrial Production. Estimate 0.8%

- 7:30 ECB Monetary Policy Meeting Accounts

*All release times are GMT

*Key events are in bold

DAX, Wednesday, January 10 at 6:20 EDT

Open: 13,361.50 High: 13,378.00 Low: 13,244.50 Close: 13,291.50