The DAX index has posted losses in the Thursday session. Currently, the DAX is at 13,057.00, down 0.57% on the day. On the release front, manufacturing indicators continue to climb, as German and Eurozone Manufacturing PMIs improved to 63.3 and 60.6 points, respectively. There was more good news from the services sector, as Germany and Eurozone Services PMI both beat their estimates. Later in the day, the ECB is expected to maintain interest rates at a flat 0.00%.

As expected, the Federal Reserve raised the benchmark interest rate on Wednesday, to a range between 1.25% and 1.50%. This marked the third rate hike in 2017, and is reflective of a strong performance of the US economy. The Fed statement was optimistic about the economy, noting that the labor market “remained strong”. It also lowered its unemployment forecast in 2018 from 4.1% to 3.9%, and revised growth for 2018 from 2.1% to 2.5%. Despite this rosy prognosis, the dollar was broadly down after the announcement. Why? One reason is the sore point in the economy – inflation. The Fed has not changed its September forecast for rate hikes next year, with the Fed dot plot indicating that three rate hikes are projected for 2018. This disappointed some investors who would like to see four increases next year. As well, the rate statement said that the Fed did not expect the tax reform legislation to have any long-term effect on the economy, contradicting White House claims that the legislation would trigger substantial growth in the economy.

After the Fed raised rates, attention now shifts to the ECB, which will set interest rates later on Thursday. The ECB is widely expected to maintain current rates, so investors will be focusing on the follow-up press conference with ECB President Mario Draghi. If the ECB sends out an optimistic message about the economy, the euro rally could resume. Meanwhile, German indicators continue to sparkle. Manufacturing PMI hit a new record, climbing to 63.3 points. The PMI Composite Output Index, which measures business activity, improved to 58.7, its highest level since 2011. A robust German economy has been the locomotive for the eurozone, which has rebounded in 2017 with stronger growth and lower unemployment.

Economic Calendar

Thursday (December 14)

- 3:30 German Flash Manufacturing PMI. Estimate 62.1. Actual 63.3

- 3:30 German Flash Services PMI. Estimate 54.6. Actual 55.8

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 59.8. Actual 60.6

- 4:00 Eurozone Flash Services PMI. Estimate 56.0. Actual 56.5

- 7:45 Eurozone Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

Friday (December 15)

- 5:00 Eurozone Trade Balance. Estimate 24.4B

*All release times are GMT

*Key events are in bold

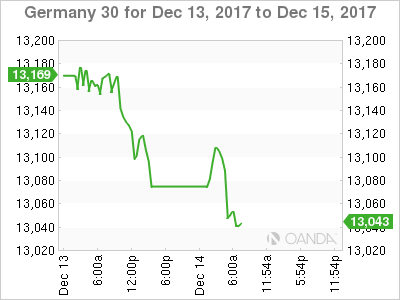

DAX, Thursday, December 14 at 7:05 EDT

Open: 13,093.25 High: 13,120.25 Low: 13,035.50 Close: 13,057.00