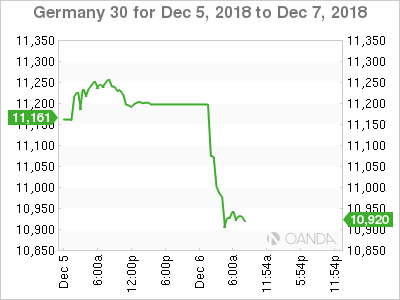

The DAX index has dropped sharply in the Thursday session. Currently, the index is at 10,932, down 2.4% since the Wednesday close. On the release front, German Factory Orders posted a gain of 0.3%, beating the forecast of -0.4%. OPEC members are meeting in Vienna for a second straight day. On Friday, Germany releases industrial production, and the eurozone will publish jobless claims and GDP. The U.S. will release nonfarm payrolls, which should be treated as a market-mover.

It’s been a dismal week for the DAX, which has nosedived 5.25%. Earlier in the day, the pair dropped below the 11,000 mark, for the first time since December 2016. Bank and automaker shares are dragging down the DAX on Thursday. Deutsche Bank (DE:DBKGn) has dropped 3.55%, Daimler is down 3.28% and Volkswagen (DE:VOWG_p) has declined 2.73%. Investors remain jittery about global economic growth and the U.S- China trade war. President Trump has agreed to suspend further tariffs for 90 days, and this move gave a boost to equity markets at the beginning of the week. However, risk apprehension quickly returned, leading to sharp losses this week. Negotiations between the U.S. and China promise to be difficult, which could mean more headwinds for the DAX.

After a string of disappointing releases out of Germany, there was some good news on the manufacturing front on Thursday. Factory orders posted a gain of 0.3% for a second straight month. This follows a lukewarm Manufacturing PMI release earlier in the week. Although the reading of 51.8 was within expectations, it marked a fourth monthly downturn and was the lowest reading since April 2016. The global trade war has taken a bite out of German exports and a slowdown in the eurozone economy has dampened manufacturing growth in Germany. On Friday, Germany releases industrial production, which is expected to edge up to 0.3%.

Economic Calendar

Thursday (December 6)

- All Day – OPEC Meetings

- 2:00 German Factory Orders. Estimate -0.4%. Actual 0.3%

Friday (December 7)

- 2:00 German Industrial Production. Estimate 0.3%

- 5:00 Eurozone Final Employment Change. Estimate 0.2%

- 5:00 Eurozone Revised GDP. Estimate 0.2%

- 8:30 US Average Hourly Earnings. Estimate 0.3%

*All release times are DST

*Key events are in bold

DAX, Thursday, December 6 at 7:25 EST

Previous Close: 11,200 Open: 11,70 Low: 10,884 High: 11,074 Close: 10,932