The DAX index has posted slight losses in the Thursday session. Currently, the DAX is trading at 12,758.00. On the economic front, there are no German or French events on the schedule. The president of the ECB, Mario Draghi, will speak at an event at the University of Tel Aviv.

World stock markets continue to lose ground due to the political turmoil which has gripped Washington. The latest development is that the Justice Department has agreed to appoint a former FBI director as independent counsel to investigate possible Russian involvement in the US presidential election as well as any connection between Trump and the Russians during the election campaign.

On Tuesday, media reports surfaced that Trump asked former FBI director James Comey to end an investigation into ties between Russia and Trump’s former security adviser, Michael Flynn. Adding to Trump’s troubles, the president is under fire for passing classified intelligence to the Russian foreign minister. Trump initially denied the claim, but has since admitted that he did share intelligence with the Russians, arguing that he had acted within his rights. With the Trump administration frantically trying to douse political fires, investors are growing increasingly nervous that Trump’s plans for a stimulus package and tax reform will stall, and these jitters have sent stock markets downwards.

Almost forgotten amidst the unfolding developments in Washington are strong consumer inflation and spending numbers in the eurozone. Final CPI for April matched the forecast with a strong gain of 1.9% in April, considerably higher than last month’s gain of 1.5%. Eurozone inflation is closing in on the ECB’s target of 2.0%, which could increase pressure on the ECB to consider tapering its ultra-loose monetary policy.

Germany, for example, is complaining that ultra-low interest rates are not suitable for its economy, which has been growing at a faster rate than the rest of the euro-area. German officials continue to call on the ECB to adopt a tighter monetary policy. On Tuesday, Eurozone Flash GDP for the first quarter was unrevised from the April forecast, posting a gain of 0.5% in the first quarter. The eurozone continues to show improved numbers in 2017, boosted in no small part by the German economy, which expanded 0.6% in the first quarter.

Economic Calendar

Thursday (May 18)

- 13:00 ECB President Mario Draghi Speaks

Friday (May 19)

- 2:00 German PPI. Estimate 0.2%

- 4:00 Eurozone Current Account. Estimate 32.3B

- 10:00 Eurozone Consumer Confidence. Estimate -3

*All release times are EDT

*Key events are in bold

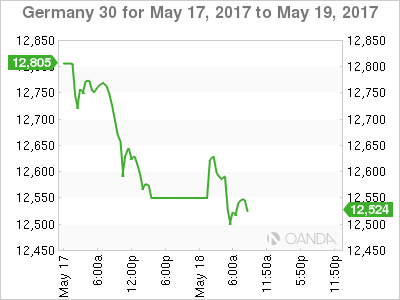

DAX, Thursday, May 18 at 8:10 EDT

Open: 12,632.00 High: 12,637.50 Low: 12,493.75 Close: 12,532.50