The DAX has edged lower in the Monday session. Currently, the DAX is at 12,921, down 0.13% on the day. There are no German or eurozone events on the schedule, so traders can expect the DAX to have a quiet day.

The twists and turns of Italian politics continue, and an extraordinary weekend may have triggered a fresh political crisis. On Sunday, President Sergio Mattarella vetoed the choice of economic minister by the two parties entrusted with forming a coalition, the League Nord and the Five Star Movement. Mattarella rejected the suggestion of Paolo Savona for economic minister, given that Savona is a firm critic of the euro and supports Italy exiting from the eurozone. The head of the Five Star Movement demanded that Mattarella be impeached, charging that the president was taking orders from Brussels. On Friday, Moody’s rating agency said that it could reduce Italy’s sovereign debt rating over fears of the new government’s fiscal policies. The current impasse may result in another general election, which could sour investor sentiment and send the euro lower.

What can we expect from the ECB? The bank is scheduled to wind up its massive stimulus program in September, but weak growth in the first quarter has raised speculation that the bank could decide to extend the program, a tactic it has often used in the past. Still, most analysts believe that the ECB will go ahead and terminate stimulus, but there is more uncertainty regarding future rate hikes. Higher oil prices and a weaker euro will likely mean that inflation is moving upwards, but core inflation projections, which ECB policymakers are most interested in, are expected to remain below the ECB inflation target of just below 2 percent. Investors will be keeping a close look at upcoming rate statements, looking for clues regarding the wind-up of the stimulus scheme.

Economic Fundamentals

Monday (May 28)

- There are no Eurozone or German events

Tuesday (May 29)

- 4:00 Eurozone M3 Money Supply. Estimate 3.9%

- 4:00 Eurozone Private Loans. Estimate 3.2%

*All release times are DST

*Key events are in bold

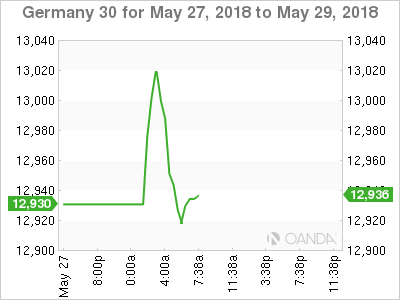

DAX, Monday, May 28 at 6:45 DST

Open: 13,001 Low: 12,894 High: 13,040 Close: 12,921

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.