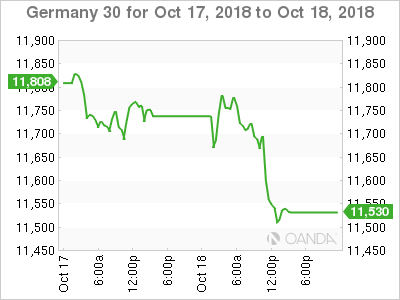

The DAX index continues to lose ground on Friday, after sharp losses in the past two sessions. Currently, the index is at 11,552, down 0.32% on the day. The index has given up the strong gains which it recorded early in the week. The sole event on the schedule is the eurozone current account surplus, which widened from EUR 21.3 billion to 23.9 billion. This easily beat the estimate of EUR 21.4 billion.

This week’s EU summit came and went without a statement on the Brexit negotiations, one of the most important issues facing the EU. European leaders openly expressed their pessimism over reaching a deal, unless Theresa May brings fresh proposals to the table. In a conciliatory move, Michel Barnier, chief Brexit negotiator for the EU, offered to extend the transition phase by 12 months, which would leave it in place until December 2021. This would give the sides more time to work on the shape of a new customs union as well as outstanding issues. Prime Minister May said she would consider extending the transition stage “for a few months”, but even this suggestion has raised the ire of Brexiteers in the cabinet, who want a clean cut from Brussels. With the Brexit negotiations at an impasse, the mood over Brexit is so sour that officials are saying that they may not hold a November EU summit, unless substantial progress is made in the next several weeks.

Italy’s draft budget has become the latest crisis for the European Union. The budget boosts public spending and cuts taxes, would raise the country’s deficit, which breaches EU rules. The government has sent the budget for approval to the European Union. On Thursday, the European Commission told Italy that the budget was not acceptable, and demanded a reply by Monday. This could put Rome and Brussels on a collision course, and the sour mood has sent Italian bond prices higher. The yield on 10-year Italian bonds stands at 3.73%, some 3.33% over the equivalent German bonds, as the gap between the two continues to widen. Bond prices in Spain, Portugal and Greece have also increased, making investors nervous. Italy’s debt stands at an astounding 132% of GDP, and there is a real risk that the country’s financial woes could destabilize the entire eurozone.

Economic Calendar

Friday (October 19)

- 4:00 Eurozone Current Account. Estimate 21.4B. Actual 23.9B

*Key events are in bold

DAX, Friday, October 19 at 6:35 DST

Previous Close: 11,589 Open: 11,595 Low: 11,499 High: 11,617 Close: 11,552