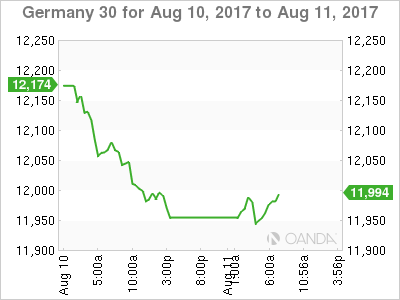

The DAX index has posted losses in the Friday session. Currently, the DAX is trading at 11,984.00, down 0.30% on the day. On the release front, German Final CPI improved to 0.4%, matching the forecast. German Final WPI was unable to keep pace, posting a decline of 0.1%, well below the forecast of 0.3%.

Global markets continue to take it on chin over rising tensions between North Korea and the US. Stock markets in Asia and Europe are down on Friday, as investors have dumped shares in favor of safe-haven assets, such as the Japanese yen and gold. German government bonds, which are considered extremely safe, are also in hot demand. North Korea has vowed to retaliate over new sanctions imposed by Washington and has threatened to attack Guam, which is a major US military base. President Trump and North Korean President Kim Jong-un are on a possible collision course, which has caused alarm in South Korea and Japan, strong allies of the US. The present situation is being compared to the Cuban Missile crisis, and although the likelihood of actual hostilities breaking out remains small, the crisis has reached levels where the markets cannot ignore it.

Eurozone inflation levels remain weak, as the July rate of 1.3% was well off the ECB’s target of 2.0%. Germany’s economy is the star of the continent, but it has not been immune to low inflation. Still, there was some positive news on Friday, as Final CPI in July climbed to 0.4%, up from 0.0% a month earlier. This marked a 4-month high. Next week, the ECB releases Final CPI, and a weak reading could dampen investor confidence and send the euro lower.

The cautious ECB has had little to say about its asset purchases program (QE) in recent months, but that could soon change. At its July policy meeting, the bank said it would hold discussions on the scheme in “the autumn”, and analysts are split as to whether that means September or October. Either way, this means that the markets expect to hear shortly from the ECB that it will begin winding down its aggressive QE policy, given the stronger economic conditions in the euro zone. The bloc’s economy is forecast to expand a healthy 2.0% this year, and the eurozone outperformed both the US and the UK in the first half of 2017. The sore point remains inflation, which is stuck at low levels, despite the ECB’s ultra-accommodative monetary policy. Another factor which policymakers must deal with is the ECB’s bloated balance sheet, which stands at more than EUR 2 trillion. With the Federal Reserve expected to begin trimming its balance sheet as early as September, investors will be keeping a close eye on the ECB and the Fed once the summer is over.

Economic Calendar

Friday (August 11)

- 2:00 German Final CPI. Estimate 0.4%. Actual 0.4%

- 2:00 German WPI. Estimate +0.3%. Actual -0.1%

- 2:45 French Final CPI. Estimate -0.3%. Actual -0.3%

- 2:45 French Preliminary Nonfarm Payrolls. Estimate 0.4%. Actual 0.5%

*All release times are EDT

*Key events are in bold

DAX, Friday, August 11 at 6:40 EDT

Open: 11,971.00 High: 11,999.50 Low: 11,936.00 Close: 11,984.00