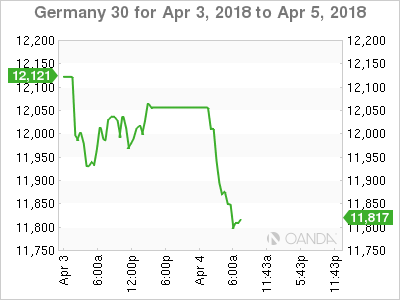

The DAX index has posted strong losses in the Wednesday session. Currently, the DAX is trading at 11,813 points, down 1.57% on the day. On the release front, it’s another busy day. In the eurozone, inflation indicators were within expectations. CPI Flash Estimate rose to 1.4%, matching the forecast. Core CPI Flash Estimate remained unchanged at 1.0%, just shy of the estimate of 1.1%. Eurozone unemployment ticked lower to 8.5%, matching the forecast. On Thursday, Germany releases Factory Orders and Final Services PMI, and the eurozone will publish PPI and Retail Sales.

With the eurozone economy continuing to perform well, and unemployment levels have been steadily falling. The rate dipped to 8.5% in February, compared to 9.5% in February 2017. This marked the lowest unemployment rate since December 2008. Inflation levels remain slightly above 1 percent, well below the ECB target of around 2 percent. This means that the ECB is unlikely to change its monetary policy, although Germany wants to see a tighter policy, which would be better suited to its robust economy. In January, the ECB tapered its stimulus program, from EUR 60 billion to 30 billion per month. The stimulus is scheduled to wind up in September, and it remains an open question as to whether Mario Draghi will extend the scheme. If the eurozone economy remains on track and inflation moves higher, there is a strong likelihood that the ECB will adopt a policy of normalization, after years of stimulus.

After a break for Easter, European stock markets are seeing red over fears of a trade war between the US and China. The Chinese government fired the latest salvo on Wednesday. China announced 25% tariffs on 106 American products, including soy beans, wheat, aircraft and motor vehicles. The value of these US exports amounts to some $50 billion – the same value as Chinese exports which have been slapped with tariffs by President Trump. This represents a significant escalation of the tariff battle, and understandably has the markets worried. China’s deputy finance minister has said that a trade war between the two sides would be a ‘lose-lose’, and few investors would disagree with his diagnosis. However, neither Trump nor Chinese President Xi Jinping has blinked so far, and the crisis shows no signs of being resolved anytime soon. As one US analyst wrote this week, “trade wars are easy to start but hard to stop.” If the trade dispute drags on, traders should be prepared for the market’s downward spiral to continue.

Economic Fundamentals

Wednesday (April 4)

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.4%. Actual 1.4%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.1%. Actual 1.2%

- 5:00 Eurozone Unemployment Rate. Estimate 8.5%. Actual 8.5%

Thursday (April 5)

- 2:00 German Factory Orders. Estimate 1.6%

- 3:55 German Final Services PMI. Estimate 54.2

- 5:00 Eurozone PPI. Estimate 0.0%

- 5:00 Eurozone Retail Sales. Estimate 0.6%

*All release times are DST

*Key events are in bold

DAX, Wednesday, April 4 at 6:40 EDT

Prev. Close: 12,002 Open: 12,003 Low: 11,792 High: 12,010 Close: 11,813