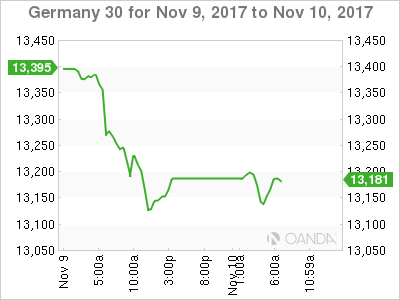

The DAX has edged lower on Friday, after three straight losing sessions. Currently, the DAX is at 13,161.25, down 0.17% on the day. On the release front, there are no German or eurozone events on the schedule.

The cautious ECB finally pressed the trigger on its stimulus program in October, after months of staying on the sidelines. A stronger eurozone economy, led by Germany, enabled the central bank to cut monthly asset purchases from EUR 60 billion to 30 billion, starting next year. However, the Bank also extended the program until September 2018, due to concerns about inflation, which remain well below the ECB target of 2 percent. Some ECB policymakers have expressed reservations about the gradual pace of trimming stimulus, arguing that the Bank should cut the asset purchases at a faster rate.

Governing Council member Philip Lane, head of the Irish central bank, said on Thursday that if inflation moves closer to 2 percent, the ECB should tighten at a fast pace. The heads of the German and Austrian central banks, who are also on the Governing Council, went even further, saying that the ECB should have indicated a clear intent to end asset purchases, rather than announce an extension. If eurozone indicators continue to point upwards, ECB President Mario Draghi will be under more pressure to tighten policy.

German coalition talks are continuing, and there is major progress to report this week. After intense negotiations, President Angela Merkel has narrowed some gaps, convincing potential partners to drop key demands. Merkel’s conservative bloc saw its support erode in the election, and will need the support of two smaller parties, the Greens and the liberal FDU, in order to form a government. The Greens have dropped a key environmental demand which involved the phase-out of fossil fuels. For its part, the FDU wanted to slash taxes by 30-40 billion euros, but has agreed to more moderate tax cuts. Merkel has been under pressure from her own bloc to tighten immigration policy, but the Greens are opposed to such a move. If the talks continue to progress, Merkel could have a government in place in December.

Economic Calendar

Friday (November 10)

- There are no German or eurozone events

*All release times are GMT

*Key events are in bold

DAX, Friday, November 10 at 6:00 EDT

Open: 13,199.00 High: 13,217.50 Low: 13,131.00 Close: 13,161.25