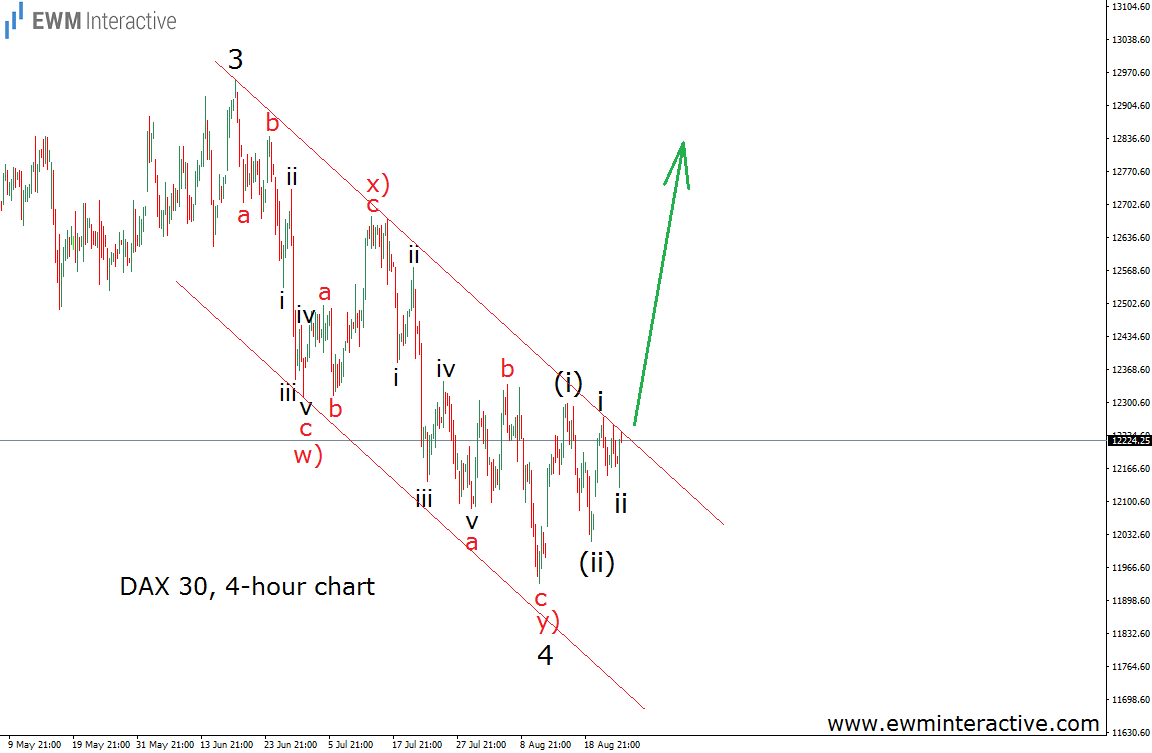

We already shared with you our long-term and mid-term outlook of the German DAX 30 index, we decided it was time to take a look at the short-term, as well. The blue chip average recently pulled back from its all-time high of 12 951 and fell to as low as 11 934 earlier this month. What interests us is the wave structure of this decline. According to the Elliott Wave Principle, every trend is interrupted by a three-wave correction from time to time. Therefore, if DAX’s uptrend is still in progress, the post-12 951 dip should have a three-wave structure. Let’s check this on the 4-hour chart below.

Fortunately for the bulls, it looks like the best the bears were able to achieve was a w)-x)-x) double zig-zag retracement in wave 4, which has been developing between the parallel lines of a corrective channel. The impulsive structure of waves “c” of w) and “a” of y) are also clearly visible. The index is already touching the upper line of this channel, which makes us think we may see a bullish breakout soon.

If this is the correct count, as long as the low at 11 934 stays intact, the German DAX should accelerate to the north and eventually take out the top of wave 3 at 12 951. While hovering around 12 225, the market appears to be offering a good risk/reward opportunity with targets above the 13 000 mark. In fact, depending on their risk-tolerance, traders could choose to put their stop-loss orders at 12 021 or 12 128, as well.