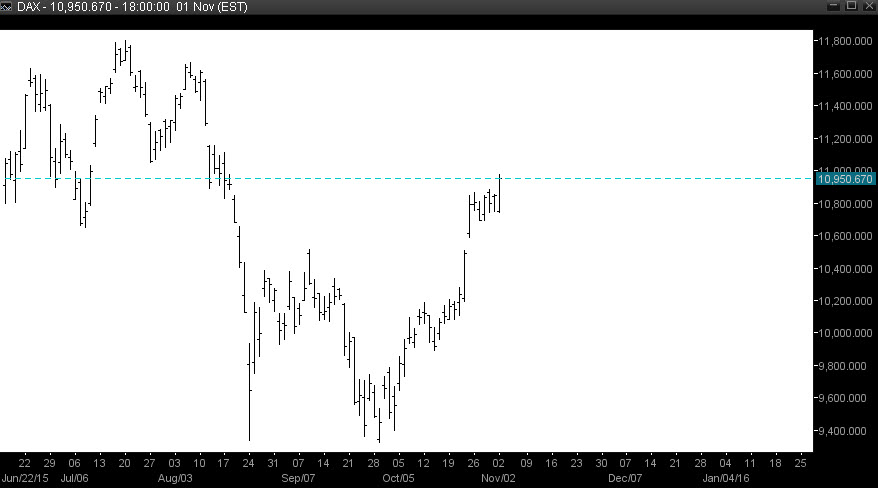

During the session on Monday, the DAX rose above the €10,950 level, and it now appears that we are ready to go much higher. We did struggle of course out the €11,000 level, but quite frankly, it’s only a matter of time before we break above there. We believe that CFD and binary options markets will be the way to go when trading the DAX.

Nonetheless, it does appear that there is more than enough support just below to keep this market going afloat, as the €10,750 level offered support yet again. With this, we are looking for short-term pullbacks in order to start buying again, via either calls for the CFD market. Going forward, we anticipate that this market should reach towards the €11,800 level, and possibly even higher than that given enough time.

The market has seen quite a bit of strength recently, and then took a bit of a break over the last several sessions until Monday. Ultimately, the market should continue to go higher on a break above the top of the range for Monday and of course pullbacks that show signs of support.

We have no interest whatsoever in selling this market, as the €10,000 level below is essentially what we consider to be the “floor” at this point in time, but really would be surprised if we got down that low. With this, we are buyers and buyers again. We think it possible to buy a short-term pullbacks for those of you who are shorter-term traders, as the trend seems to be ready to continue to the upside. There will be noise though, keep that in mind.

Looking at the DAX, you have to keep in mind that it tends to leave the rest of Europe, and as a result it makes sense that this market would go higher before several of the other ones do. Once the DAX breaks out completely, the market should attract buyers and a bit of a “snowball effect.” On top of that, it could lead to higher pricing in other markets such as the CAC, the MIB, and the Ibex.