The DAX index has posted strong gains in the Thursday session, erasing the losses seen on Wednesday. Currently, the DAX is at 13,168.00, up 0.80% on the day. On the release front, German Retail Sales declined 1.2%, well off the estimate of 0.3%. German unemployment change declined by 18 thousand, better than the estimate of -10 thousand. Eurozone CPI Flash Estimate edged up to 1.5%, but this was shy of the forecast of 1.6%. On Friday, manufacturing indicators will be in focus, as Germany and the eurozone release Final Manufacturing PMI reports.

German retail sales remain a concern, and posted a sharp decline of 1.2% in October. This marked the third decline in four months. Germany’s economy is solid and the labor market is strong, so why isn’t the German consumer spending? Strong economic conditions have not translated into higher wages for a large segment of the labor force, and low unemployment numbers have masked the problem of underemployment, ,which of course means lower wages for workers who can’t find full-time work. The lack of inflation in Germany is apparent in the eurozone as well, as inflation levels remain below the ECB’s inflation target of around 2 percent.

There are new developments in the German political saga, as President Angela Merkel continues efforts to form a new government. Coalition talks will now center on Merkel’s conservative bloc (CDU) and the social democrats (SPD). After the election, the SPD announced that it would remain in the opposition. However, coalition talks imploded when the Free Democrats pulled out of the negotiations and there is pressure on the SPD to reconsider in order to avoid elections. The SPD is split on whether to join a coalition with Merkel, as many SPD members don’t want the SPD to be relegated to a junior party in the coalition, as was the case prior to the election. Although the SPD has agreed to exploratory meetings with the CDU, substantial talks of a “grand coalition” are not expected to start before 2018. The SPD is likely to take advantage of Merkel’s weak hand and press demands for greater government spending and a looser immigration policy. The SPD could even demand the powerful finance ministry.

Economic Calendar

Thursday (November 30)

- 2:00 German Retail Sales. Estimate +0.3%. Actual -1.2%

- 3:55 German Unemployment Change. Estimate -10K. Actual -18K

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.6%. Actual 1.5%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.0%. Actual 0.9%

- 5:00 Eurozone Unemployment Rate. Estimate 8.9%. Actual 8.8%

Friday (December 1)

- 3:55 German Final Manufacturing PMI. Estimate 62.5

- 4:00 Eurozone Final Manufacturing PMI. Estimate 60.0

*All release times are GMT

*Key events are in bold

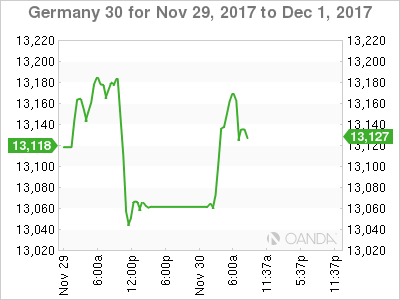

DAX, Thursday, November 30 at 6:45 EDT

Open: 13,061.00 High: 13,181.50 Low: 13,039.00 Close: 13,164.25