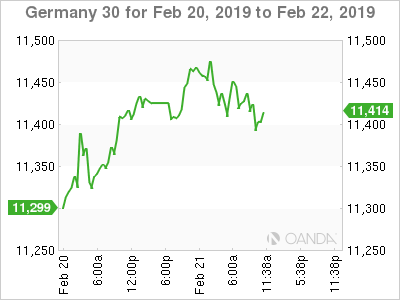

The DAX index continues to head higher this week. Currently, the DAX is at 11,418, up 0.14% on the day. It’s a busy day on the release front. German CPI declined 0.8%, matching the forecast. Manufacturing data was dismal, as German and eurozone manufacturing PMIs dropped below the 50-level, pointing to contraction. Services PMIs were stronger, as the German and eurozone readings indicated expansion. As well, the ECB releases the minutes of the January policy meeting. On Friday, Germany releases GDP and Ifo Business Climate, and the eurozone will post CPI data.

The global trade war continues to weigh on the manufacturing sectors worldwide, and the eurozone and Germany have not been immune. German manufacturing PMI fell to 47.6, its second successive contraction. This was the lowest level since December 2012. The all-euro reading slipped to 49.2, its first contraction since June 2013. Earlier this week, ZEW economic sentiment surveys posted scores deep in negative territory for Germany and the eurozone. With the German locomotive showing clear signs of a slowdown, the ECB is unlikely to raise rates in the near future, possibly holding off until 2020.

There is increasing optimism over the U.S-China trade talks. The sides are holding a fourth round of talks in Washington this week. The talks are reportedly making substantial progress, as negotiators are preparing memorandums of understanding on key issues such as cyber theft and intellectual property rights. The trade war has triggered a slowdown in China and weighed on global stock markets. The U.S. has threatened to raise tariffs on March 1 if a deal is not reached, so there is strong pressure to reach a deal before the deadline. If the negotiations continue to make progress, traders can expect the DAX to move higher.

Economic Calendar

Thursday (February 21)

- 2:00 German Final CPI. Estimate -0.8%. Actual -0.8%

- 3:30 German Flash Manufacturing PMI. Estimate 49.7. Actual 47.6

- 3:30 German Flash Services PMI. Estimate 52.8. Actual 55.1

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 50.3. Actual 49.2

- 4:00 Eurozone Flash Services PMI. Estimate 51.4. Actual 52.3

- 7:30 ECB Monetary Policy Meeting Account

Friday (February 22)

- 2:00 German Final GDP. Estimate 0.0%

- 4:00 German Ifo Business Climate. Estimate 99.0

- 5:00 Eurozone Final CPI. Estimate 1.4%

- 5:00 Eurozone Final Core CPI. Estimate 1.1%

- 10:30 ECB President Draghi Speaks

*All release times are DST

*Key events are in bold

DAX, Thursday, February 21 at 7:25 EST

Previous Close: 11,401 Open: 11,447 Low: 11,403 High: 11,455 Close: 11,418