The DAX is showing little movement in the Monday session. Currently, the index is trading at 13,334.50, down 0.04% since the close on Friday. On the release front, there is just one eurozone indicator. German Import Prices slowed to 0.3%, matching the estimate. On Tuesday, Germany releases Primary CPI and the eurozone publishes Preliminary Flash GDP for fourth quarter 2016. In the US, President Trump will deliver the State of the Union address.

The euro posted sharp gains on Thursday after comments from ECB President Mario Draghi, but the gains didn’t last, as EUR/USD continues to show limited movement. Draghi was more dovish than expected, saying that the ECB was prepared to increase QE in “size or duration”, a reminder to the markets that it is premature to expect normalization anytime soon. He added that interest rates would not rise until well after the ECB’s asset-purchase program (QE) was over. The QE program will not end until September at the earliest, so Draghi essentially ruled out any rate hikes before early 2019. A new headache for ECB policymakers is the streaking euro, which has hit 3-year highs against the US dollar. EUR/USD has jumped 3.3% in January, as the dollar continues to struggle.

Investors are also concerned about the streaking euro, which could hurt exports and affect company earnings. The euro posted strong gains on Wednesday, after US Treasury Secretary Steven Mnuchin said that the US had no problem with a weak dollar. ECB policymakers were not pleased with Mnuchin’s statement, and Mario Draghi, without naming Mnuchin, said that such comments amounted to “targeting the exchange rate”. Mnuchin has since backtracked, saying that his words were taken out of context and that the US has a long-term interest in a strong dollar. President Trump added that Mnuchin was misinterpreted, but these attempts at damage control haven’t had much effect, as EUR/USD has traded sideways since the Mnuchin comments.

Economic Calendar

Monday (January 29)

- 2:00 German Import Prices. Estimate 0.3%. Actual 0.3%

Tuesday (January 30)

- All Day – German Preliminary CPI. Estimate -0.5%

- 5:00 Eurozone Preliminary Flash GDP. Estimate 0.6%

- 21:00 President Trump Speaks

*All release times are GMT

*Key events are in bold

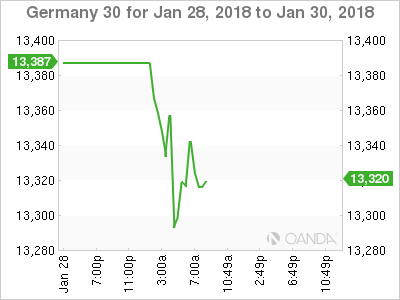

DAX, Monday, January 29 at 7:30 EDT

Open: 13,294.50 High: 13,372.50 Low: 13,278.50 Close: 13,328.50