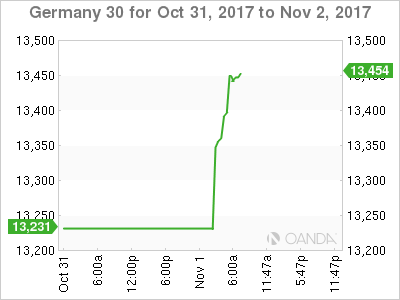

The DAX has posted considerable gains in the Wednesday session. Currently, the DAX is at 13,442.00, up 1.61% on the day. On the release front, there are no eurozone or German indicators on the schedule. Today’s highlight is the Federal Reserve rate statement. On Thursday, Germany publishes Final Manufacturing and PMI and unemployment change, and the eurozone releases Final Manufacturing PMI.

The DAX has posted strong gains on Wednesday, after positive corporate earnings releases. Most companies on the DAX are showing gains, including BMW (1.56%), Daimler (1.92%), Infineon (3.43%) and Volkswagen (DE:VOWG_p) (2.55%). The DAX continues to set record highs, and has climbed 3.2% since October 23. German stock markets have also been buoyed by strong German numbers, and with the economy expected to record a healthy fourth quarter, the DAX rally could continue.

In Germany, retail sales rebounded in impressive fashion, gaining 0.5% after two straight declines. On an annualized basis, retail sales gained 4.1%, indicative of strong consumer spending. Germany Preliminary CPI edged down to 0.0%, shy of the forecast of 0.1%. This follows two consecutive readings of 0.1% and points to continuing low inflation in an otherwise robust economy.

After months of speculation, the ECB announced last week that it will begin tapering its asset purchase program, from EUR 60 billion/mth to EUR 30 billion/mth. The program, which was scheduled to end in December, has been extended to April 2018. However, ECB President Mario Draghi added a dovish twist to the move, stating that the program would remain open-ended. This provides the cautious ECB with the ability to keep the program in place beyond April without causing strong movement in the currency and stock markets. The euro has reacted sharply to ECB moves (or lack of a move) in the past, and Draghi would like to minimize the ECB’s involvement in market movement.

Economic Calendar

Wednesday (November 1)

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

Thursday (November 2)

- 4:55 German Final Manufacturing PMI. Estimate 60.5

- 4:55 German Unemployment Change. Estimate -10K

- 5:00 Eurozone Final Manufacturing PMI. Estimate 58.6

*All release times are GMT

*Key events are in bold

DAX, Wednesday, November 1 at 6:45 EDT

Open: 13,355.50 High: 13,346.50 Low: 13,345.00 Close: 13,442.00