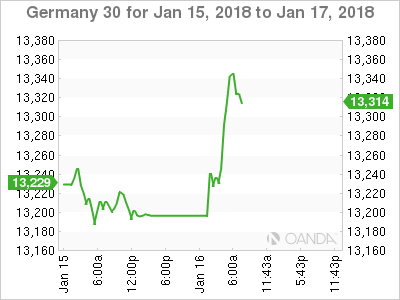

The DAX has posted gains in the Tuesday session. Currently, the index is trading at 13,306.50, up .80%. On the release front, there are no major German or eurozone releases. German inflation numbers were a mixed bag. Final CPI improved to 0.6%, matching the forecast. WPI declined 0.3%, missing the estimate of +0.3%. On Wednesday, the eurozone releases Final CPI.

The DAX jumped out of the gates after New Years’ with strong gains, but has since steadied. Will the rally resume? There are signs that favor additional gains for the German stock markets. First, the ECB minutes from the December meeting were hawkish, leading to speculation that the ECB could wind up its asset purchase program in September. In the minutes, policymakers said that risks to the current outlook were to the upside, which could necessitate a gradual shift in guidance in the next few months. As for the eurozone, the minutes stated that the economy was displaying “continued robust and increasingly self-sustaining economic expansion”. Policymakers have echoed the sentiment that tighter policy could be on the way. On Monday, ECB Governing Council member Ardo Hansson said if the economy and inflation develop as expected, the ECB could wind up the asset purchase program in one shot after September.

The second factor is major progress in coalition negotiations in Germany, raising hopes that the political stalemate may soon be over. There was a report on Friday that Angela Merkel’s conservative bloc and the Social Democrats have agreed on a coalition draft. This ends months of political uncertainty, which has eroded Merkel’s standing and also sidelined Germany on key issues such as Brexit and political reform in the eurozone. Still, the talks are only in the preliminary stage, and further negotiations will take at least several weeks before it is clear that the talks have been successful.

Economic Calendar

Tuesday (January 16)

- 2:00 German Final CPI. Estimate 0.6%. Actual 0.6%

- 2:45 German WPI. Estimate +03%. Actual -0.3%

- 3:00 French Government Budget Balance. Estimate -84.7B

Wednesday (January 17)

- 5:00 Eurozone Final CPI. Estimate 1.4%.

- 5:00 Eurozone Final Core CPI. Estimate 0.9%.

- Tentative – German 30-year Bond Auction

*All release times are GMT

*Key events are in bold

DAX, Tuesday, January 16 at 12:20 EDT

Open: 13,242.50 High: 13,245.50 Low: 13,170.00 Close: 13,306.50