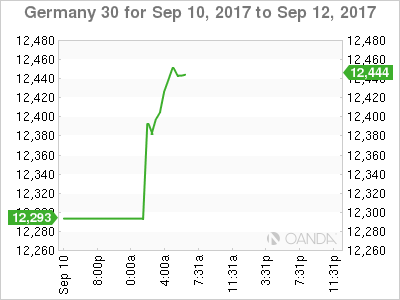

The DAX index has posted strong gains in the Monday session. Currently, the DAX is trading at 12,439.50, up 1.09% on the day. There are no German or Eurozone events on the schedule.

Global markets sighed in relief on the weekend, as the Korean peninsula remained quiet. With North Korea celebrating its 69th anniversary of independence, there were concerns that Pyongyang would use the occasion to flex some muscle and test a nuclear bomb or missile. North Korea marked last year’s anniversary by exploding its fifth nuclear test. This occasion passed without incident, although the US, along with its allies Japan and South Korea, remain on alert for further provocations from the north. European stock markets have continued the upward trend seen in Asia, as the DAX is up more than 1 percent. Earlier in the Monday session, the DAX hit its highest level since July 21. Monday’s gains have been felt in most of the DAX’s 30 companies, particularly in banking stocks – Deutsche Bank (DE:DBKGn) is up 2.51% and Commerzbank (DE:CBKG) has gained 2.85%.

The ECB policy meeting on Thursday appeared to send mixed signals about the bank’s quantitative easing (QE) program, which ends in December. Currently, the bank is purchasing EUR 60 billion/month and the markets were hoping for some guidance about the ECB’s monetary policy plans. The rate announcement was surprisingly dovish, as policymakers said that QE would not be tapered before December, and left the door open to further stimulus in 2018, if necessary. However, Mario Draghi presented a more hawkish stance in his follow-up press conference, saying that the ECB would make a decision on how to scale back stimulus in October. In his remarks, Draghi made direct reference to the exchange rate, noting that “the recent volatility in the exchange rate represents a source of uncertainty which requires monitoring”.

Draghi & Co. are clearly concerned by the euro’s appreciation, as the EUR/USD has soared 14 percent in 2017. The stronger euro has made imports less expensive, thus reducing inflation and hampering the ECB’s efforts to raise inflation levels with zero interest rates and the ultra-accommodative QE scheme. Despite an improved eurozone economy, the ECB has now cut its inflation forecast to 1.2 percent in 2018 and 1.5 percent in 2019, well short of its target of just below 2 percent. It is unclear what the ECB has planned when QE runs out, and the markets will be listening closely for any hints from policymakers.

Economic Calendar

Monday (September 11)

- There are no German or Eurozone events

*All release times are EDT

*Key events are in bold

DAX, Monday, September 11 at 5:30 EDT

Open: 12,385.75 High: 12,458.50 Low: 12,374.25 Close: 12,439.50