The DAX has hit record highs on Friday, buoyed by the ECB decision to taper its bond-buying program but also extend the scheme to September 2018. Currently, the DAX is at 13,242.00, up 0.81%. On the release front, the sole eurozone event is German Import Prices, which posted a gain of 0.9%. This beat the estimate of 0.5%, and marked the first gain since February. The US will release Advance GDP, which is expected to gain 2.5%.

It was Black Thursday for the euro, but European stock markets were up sharply, and the gains have continued on Friday. The DAX responded to the ECB decision to taper its quantitative easing program with strong gains of 1.4% on Thursday. As expected, the ECB finally pressed the trigger and chopped QE from EUR 60 billion to 30 billion/mth. The ECB extended the program, which was due to terminate in December, to September 2018. However, many investors were hoping that the ECB would not only taper the bond-buying scheme, but would also announce a date when the program would end. ECB President Mario Draghi has given himself plenty of wiggle room, as he can simply extend QE beyond next September. The ECB maintained interest rates at a flat 0.00%, and Draghi provided no hints about the timing of future rate hikes. The ECB appears in no rush to tinker with rate policy, and we’re unlikely to see any rate increases until QE is completed.

Earlier this week, German Ifo Business Climate jumped to 116.7, an all-time high. The business sector is very optimistic about the robust economy, and appears unfazed by German coalition talks and the deadlock in the Brexit talks. The strong reading suggests that the German economy will enjoy a strong fourth quarter. German policymakers insist that the ECB’s interest rate policy is too loose for Germany, but the economy is still expected to thrive. Earlier in the week, German Manufacturing PMI posted a strong reading of 60.5 points, beating expectations. The manufacturing sector continues to expand, buoyed by strong domestic demand and the global appetite for German exports.

Economic Calendar

Friday (October 27)

- 2:00 German Import Prices. Estimate 0.5%

- 8:30 US Advance GDP. Estimate 2.5%

*All release times are GMT

*Key events are in bold

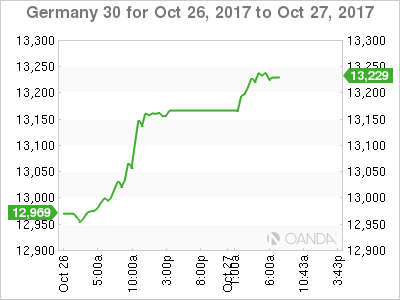

DAX, Friday, October 27 at 6:00 EDT

Open: 13,195.50 High: 13,248.50 Low: 13,185.25 Close: 13,242.00