The DAX index is unchanged in the Wednesday session. With no major events on the schedule, we can expect investors to concentrate on earnings news, so it could continue to be a quiet day for the DAX. Currently, the DAX is trading at 12,430.00, unchanged on the day. On Thursday, the ECB will release its monthly rate statement.

The Trump administration continues to flounder, as a key plank in Trump’s agenda appears dead in the water. Trump’s proposed health care bill, which replaces much of Obamacare, has stalled in the Senate before lawmakers even voted on the bill. With some conservative Republicans against the bill, it’s questionable if the Republicans can craft a new proposal which could be passed before Congress takes a recess in August. Trump had promised to pass a health care before the summer break, so his credibility will take another hit if he’s unable to do so.

With this latest defeat, there is growing skepticism as to whether Trump will be able to convince Congress to pass other key parts of his agenda – tax reform and fiscal spending. The Republicans also have egg on their faces, as they have been unable to pass any significant legislation since Trump took over, despite having control of both houses of Congress and the White House. This paralysis on Capitol Hill has deepened investor pessimism about the Trump administration and has hurt the US dollar.

Investors are keeping a close on the ECB, which holds its policy meeting on Thursday. What can we expect from Mario Draghi and Co.? The bank is unlikely to make any changes to its asset-purchase program (QE). With the eurozone showing improvement in 2017, there has been speculation that the bank might taper QE or change the expected end of the scheme, which is December of this year. The ECB makes every attempt to avoid shaking up the markets, but this policy doesn’t always work. Case in point, at the ECB forum in June, upbeat comments by ECB President Mario Draghi about tweaking QE led to a sharp rally by the euro.

If the eurozone economy continues to show strong numbers, we could see the ECB make some adjustments in its September meeting. In December 2016, the bank tapered QE while extending the scheme until December, and this type of scenario could be adopted once again. Analysts will be combing through the July statement, as well as Draghi’s press conference, looking for any nuances to tweaks which could hint at substantive changes to come in September.

Economic Calendar

Wednesday (July 19)

- Tentative – German 30-y Bond Auction

Thursday (July 20)

- 2:00 German PPI. Estimate -0.1%

- 4:00 Eurozone Current Account. Estimate 23.3B

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

- 10:00 Eurozone Consumer Confidence. Estimate -1

*All release times are EDT

*Key events are in bold

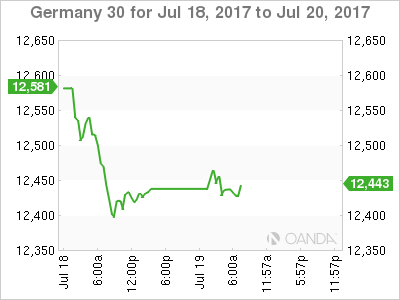

DAX, Wednesday, July 19 at 6:35 EDT

Open: 12,467.50 High: 12,476.50 Low: 12,416.00 Close: 12,435.00

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.