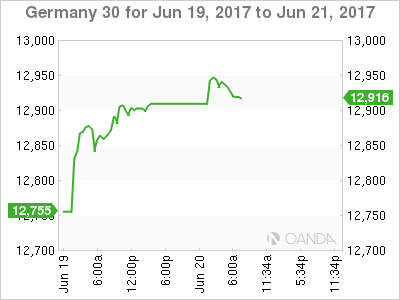

The DAX index has posted small gains in the Tuesday session. The index is up 0.22% and is currently at 12,916.30 points. Earlier in the day, the DAX set a new record high, at 12,951.50. On the release front, German PPI declined by 0.2%, weaker than the forecast of -0.1%. This marked the first decline since September 2016. Elsewhere, the Eurozone’s current account surplus dropped sharply to EUR 22.2 billion, well below the estimate of EUR 31.3 billion. This was the lowest surplus since July 2016.

German stock markets moved higher following a positive growth forecast earlier on Tuesday. The well-respected Ifo economic institute revised its prediction for Germany’s GDP for 2017 from 1.8% to 2.0%, and economic growth from 1.5% to 1.8%. The report also forecast that inflation would jump to 1.7% in 2017, up from 0.6% in 2016. The German economy has looked strong in 2017, buoyed by strong domestic demand and an increase in exports. Stronger economic conditions in Germany have helped raise growth in the euro-area as well in 2017.

One year after the Brexit referendum, which stunned Britain and the European Union, the two sides formally commenced negotiations on Monday in Brussels. The first day was primarily a photo-shoot opportunity, and the sides were on their best behavior. The parties published a concise Terms of Reference for the negotiations, which provided an outline of the talks as set by the Europeans. The paper pointedly did not mention trade talks, but rather listed the initial issues that will be discussed: 1) legal status of EU citizens in the UK; (2) Northern Ireland/Ireland border; and (3) financial obligations of the UK to the EU.

With Prime Minister May trying to cobble together a minority government, her position is much weaker than before the disastrous election, and the British position has become more flexible. Philip Hammond, the British finance minister, has said that he wants a business-friendly and pragmatic Brexit and that no deal would be bad for the UK. Hammond did, however, warn the Europeans not to craft an agreement that punished the UK for leaving the club. The negotiations are expected to resume on July 10, when the parties will delve into substantial issues.

Economic Calendar

Tuesday (June 20)

- 2:00 German PPI. Estimate -0.1%. Actual -0.2%

- 4:00 Eurozone Current Account. Estimate 31.3B. Actual 22.2B

*All release times are EDT

*Key events are in bold

DAX, Tuesday, June 20 at 6:30 EDT

Open: 12,938.99 High: 12,951.50 Low: 12,915.50 Close: 12,916.30