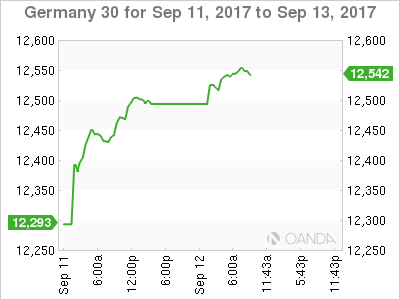

The DAX index continues to post gains this week. In the Tuesday session, the DAX is trading at 12,439.50, up 0.60% on the day. For a second straight day, there are no German or Eurozone events on the schedule. On Wednesday, Germany will release Final CPI and WPI, and the eurozone publishes employment change and industrial production.

European stock markets continue move higher, boosted by renewed investor appetite this week. The DAX has gained 3.7% in September, and is trading at its highest level since July 20.

With North Korea one of the world’s geopolitical hot spots, there were concerns that tensions might rise again over the weekend, as the country celebrated the 69th year of its founding. Last year, North Korea marked last year’s anniversary by exploding its fifth nuclear test. To the market’s relief, there were no nuclear tests or missile launches over the weekend, although Pyongyang has reacted angrily to a UN Security Council resolution which extended sanctions on North Korea. On the fundamental front, it’s been a slow start to the week, and the markets are keeping on eye on German inflation numbers, which will be released on Wednesday.

The US dollar suffered broad losses last week, as tensions rose in the Korean peninsula after North Korea tested a hydrogen bomb. This weighed on risk appetite, and the euro jumped on the bandwagon, gaining 1.3 percent against the greenback. With North Korea celebrating its 69th anniversary of independence, there were concerns that Pyongyang would use the occasion to flex some muscle and test a nuclear bomb or missile.

There were no incidents over the weekend, although the US, along with its allies Japan and South Korea, remain on alert for further provocations from the north. The dollar responded with gains on Monday, as EUR/USD dipped below the symbolic 1.20 level.

Record Highs Expected as North Korea Fears Subside

Economic Calendar

Tuesday (September 12)

- There are no German or Eurozone events

Upcoming Events

Wednesday (September 13)

- 2:00 German Final CPI. Estimate 0.1%

- 2:00 German WPI. Estimate 0.1%

- 5:00 Eurozone Employment Change. Estimate 0.3%

- 5:00 Eurozone Industrial Production. Estimate 0.0%

- Tentative – German 10-y Bond Auction

*All release times are EDT

*Key events are in bold

DAX, Tuesday, September 12 at 8:25 EDT

Open: 12,522.75 High: 12,555 Low: 12,511.50 Close: 12,549