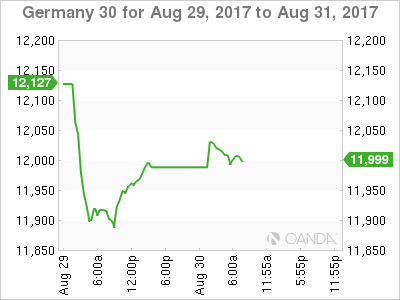

The DAX index has posted slight gains in the Wednesday session, after considerable losses on Tuesday. The DAX is currently trading at 11,999.00, up 0.53% on the day. On the release front, German Preliminary CPI will be published later in the day, with the indicator expected to weaken and post a small gain of 0.1%. In the US, Preliminary GDP is expected to gain 2.7%. On Thursday, Germany releases Retail Sales and the euro zone releases CPI Flash Estimate.

Geopolitical tensions have once again grabbed the attention of global stock markets. The DAX posted considerable on Tuesday, after North Korea fired a ballistic missile over Japanese territory. Japan and the US sharply condemned the missile launch, with President Trump saying that “all options remain on the table”. With tensions once again climbing in the Korean peninsula, investors are bracing for more stock market losses, and both gold and the Japanese yen, which tend to rise in periods of crisis, have gained ground this week.

It’s up, up and away for the euro, which as soared 12.0% since April 1. On Tuesday, the currency pushed above the 1.20 level for the first time since January 2017. The euro has benefited from stronger growth in the eurozone in 2017, led by robust growth in Germany. However, the euro’s streak has weighed on the shares of automobile makers and other exporters, as a stronger euro has made exports more expensive. Investors are anticipating that the ECB will provide some guidance on plans regarding its asset purchase program (QE), which is scheduled to terminate in December. The ECB is widely expected to taper its QE program early next year, but so far has been mum about its plans. Analysts expect the ECB to address its stimulus package at the next policy meeting on September 7.

Last week’s meeting of central bankers in Jackson Hole was a low-key affair. On Friday, ECB President Mario Draghi took a page out of Janet Yellen’s page book, opting to steer away from any discussion about ECB monetary policy. Instead, Draghi spoke about the importance of free trade and financial reforms. Draghi seems to have learned a lesson from a meeting of central bankers in Portugal in June, when the markets seized on his comments that the euro zone was undergoing a broad recovery, and the euro soared. However, Draghi won’t receive another free pass next month, when the ECB holds its next policy meeting, and is expected to address its ultra-accommodative monetary policy.

Economic Calendar

Wednesday (August 30)

- All Day – German Preliminary CPI. Estimate 0.1%

- 8:30 US Preliminary GDP. Estimate 2.7%

Upcoming Events

Thursday (August 31)

- 2:00 German Retail Sales. Estimate -0.5%

- 5:00 Euro zone CPI Flash Estimate. Estimate 1.4%

*All release times are EDT

*Key events are in bold

DAX, Wednesday, August 30 at 7:00 EDT

Open: 12,022.50 High: 12,043.50 Low: 11,988.50 Close: 12,009.50