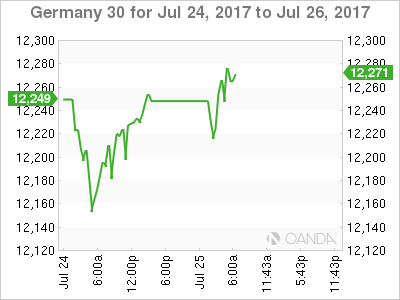

The DAX index has posted gains in the Tuesday session. Currently, DAX is trading at 12,275.00, up 0.50% on the day. On the release front, German Ifo Business Climate climbed to 116.0 points, beating the estimate of 114.9 points. German Import Prices posted a fourth straight decline, coming in at -1.1%. This reading was weaker than the estimate of -0.7%. On Wednesday, the Federal Reserve will conclude its 2-day policy meeting and publish a rate statement.

German numbers continue to move upwards. On Tuesday, German Ifo Business Climate impressed in July, as the indicator strengthened for a sixth straight month. The indicator hit another record high of 116.0, surprising the markets which had forecast a small drop from the previous reading. Clements Fuest, president of the Ifo Institute, continues to use superlatives to describe the German economy, calling sentiment in the business sector “euphoric”. Fuest added that optimism in the business sector is at its highest since Germany’s reunification.

German data continues to point upwards, and the robust economy has been the locomotive behind a reinvigorated eurozone economy. The marked improvement in economic conditions in the eurozone has sent the euro soaring, as the currency is up 9.8% since March 1. Although, the strong euro has not put a dent in business sentiment, this has not been the case with German stock markets. The high exchange rate has weighed on exporters’ shares and the DAX has declined 2.7% since June 1.

The Federal Reserve is holding its monthly policy meeting on Tuesday and Wednesday, With the odds of a rate hike at just 3%, the markets will be focused on the Fed’s rate statement, which will be released on Wednesday. US numbers in the second quarter have been mixed, and inflation remains well below the Fed target of 2.%. Given these economic conditions, investors remain skeptical as to whether the Fed will raise rates in December, with the odds currently at 47%, according to the CME Group.

Analysts will be looking for nuances in the language of the statement, and a dovish tilt from the Fed could hurt the dollar and boost the red-hot euro. Another issue for Fed policymakers is the $4.2 trillion bond portfolio, a result of the aggressive quantitative easing program which was put in place after the financial crisis in 2008. In June, the Fed outlined plans to reduce its bloated balance sheet, with experts circling September as the start date of the reduction.

Economic Calendar

Tuesday (July 25)

- 2:00 German Import Prices. Estimate -0.7%. Actual -1.1%

- 4:00 German Ifo Business Climate. Estimate 114.9. Actual 116.0

Wednesday (July 26)

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

*All release times are EDT

*Key events are in bold

DAX, Tuesday, July 25 at 12:55 EDT

Open: 12,215.50 High: 12,210.00 Low: 12,286.50 Close: 12,275.00