The DAX index has posted considerable gains in the Wednesday session, continuing the upward movement seen on Monday. The DAX is trading at 12,280.75, up 0.82% on the day. On the release front, euro zone Flash GDP edged up to 0.6% in the second quarter, matching the forecast. In the US, the Federal Reserve will release the minutes of its July policy meeting. On Thursday, the euro zone releases Final CPI and the ECB publishes the minutes of its July policy meeting.

It was report card day for the euro zone economy, with the release of Flash GDP for the second quarter. The reading was positive, posting a gain of 0.6%, edging above the 0.5% gain in Q1. The euro zone economy has now picked up speed over three consecutive quarters. Much of the credit for improved growth in the euro zone goes to Germany, whose robust economy continues to impress. Germany’s GDP expanded 0.6% in the second quarter.

Consumer spending, a key driver of economic growth, continues to propel economic growth, and the country has now posted 12 straight quarters of growth. Higher wages and increased government spending have also boosted the economy. The export sector remains strong, despite the stronger euro, as global demand for German products, especially automobiles, remains firm.

Geopolitical tensions in the Korean peninsula have abated, and this has helped boost global stock markets. The DAX has rebounded after sharp losses last week, following some saber-rattling between Washington and Pyongyang. The two countries engaged in an escalating war of words, with North Korea threatening to attack Guam, which hosts a major US military base. Although a military conflict remains unlikely, tensions remain high, and if tensions again rise, investors could head for safer pastures, and dump shares in favor of the Japanese yen and gold, which was the case last week.

Economic Calendar

Wednesday (August 16)

- 5:00 Euro zone Flash GDP. Estimate 0.6%. Actual 0.6%

- 14:00 US FOMC Meeting Minutes

Thursday (August 17)

- 5:00 Euro zone Final CPI. Estimate 1.3%

- 5:00 Euro zone Final Core CPI. Estimate 1.2%

- 5:00 Euro zone Trade Balance. Estimate 20.4B

- 7:30 ECB Monetary Policy Meeting Accounts

*All release times are EDT

*Key events are in bold

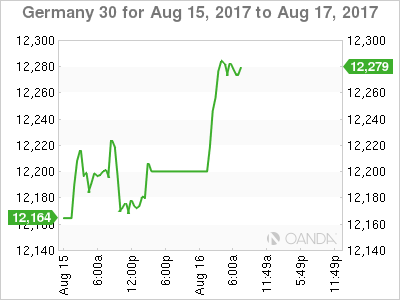

DAX, Wednesday, August 16 at 6:40 EDT

Open: 12,251.50 High: 12,291.50 Low: 12,242.00 Close: 12,280.75