The DAX has reversed directions on Wednesday, moving upwards after three losing sessions. In the Wednesday session, the index is at 12,925.00, up 0.42% on the day. On the release front, German Unemployment Change in December declined by 29,000, well below the estimate of 13,000. This marked the second-highest decline in 2017. In the US, today’s key event is the release of the Fed minutes from the December meeting.

Just a few days into the New Year, the Federal Reserve will be on center stage, with the release of the minutes of the December policy meeting. At that meeting, the Fed raised rates by 25 basis points, to a range between 1.25-1.50%. The hike marks a vote of confidence in the US economy, and if the minutes are hawkish, the US dollar could gain ground. The economy is expanding at an impressive clip of above 3 percent. If this pace continues, the Fed could raise rates up to four times in 2018. Currently, the CME Group (NASDAQ:CME) has priced in a January rate hike at 98.5%. Despite the rosy economic conditions, inflation has been chronically soft, well below the Fed target of 2 percent. Outgoing Fed Chair Janet Yellen and other FOMC members have said that they expect that the strong labor market will push up wages and trigger higher inflation, but this is yet to happen.

The German economy continues to post solid numbers in the fourth quarter of 2017. In December, inflation accelerated to 0.6%, edging above the forecast of 0.5%. The strong gain matched the February reading, equaling the strongest gain recorded in 2017. Unemployment rolls continue to fall, as the labor market continues to remain tight in a robust economy. The numbers are all the more impressive as the political landscape remains uncertain, following inconclusive elections in September. President Angela Merkel is now eyeing the Social Democrats as a coalition partner, but negotiations are moving at a slow pace.

Global stock markets enjoyed a strong year in 2017, and the DAX climbed an impressive 13.0%. Investors gave a thumbs-up as the German and eurozone economies showed solid growth, and data in the fourth quarter has been strong so Expectations remain high that the positive trend will continue into 2018, which bodes well for the DAX. As the new year begins, the markets will be keeping a close eye on the political situation in Germany, as President Angela Merkel strives to put together a new coalition. If new elections are avoided and Merkel forms a new government, the DAX is likely to post strong gains.

Economic Calendar

Wednesday (January 3)

- 3:55 German Unemployment Change. Estimate -13K. Actual -29K

- 14:00 US FOMC Meeting Minutes

Thursday (January 4)

- 3:55 German Final Services PMI. Estimate 55.8

- 4:00 Eurozone Final Services PMI. Estimate 56.5

*All release times are GMT

*Key events are in bold

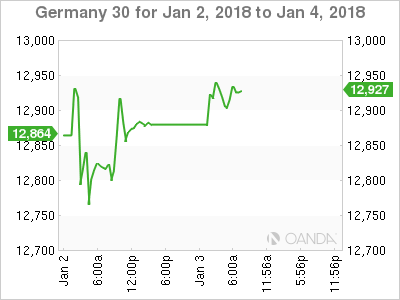

DAX, Wednesday, January 3 at 7:20 EDT

Open: 12,913.50 High: 12,948.50 Low: 12,890.50 Close: 12,925.00