The DAX has posted considerable gains in the Tuesday session. Currently, the index is trading at 13,442.50, up 0.61% on the day. On the release front, German ZEW Economic Sentiment improved to 20.4, beating the estimate of 17.8 points. Eurozone ZEW Economic Sentiment followed the same trend, climbing to 31.8, above the forecast of 29.7 points. On Wednesday, Germany and the Eurozone release services and manufacturing PMIs.

The ECB meets on Thursday, and traders should not expect any dramatics at the first policy meeting of 2018. The Bank is expected to retain its pledge to continue buying bonds under its asset-purchase program (QE), which was extended until September. The ECB has trimmed QE from EUR 60 billion to 3o billion/mth, but is likely to hold interest rates for 3-6 months after that. Still, ECB policymakers have hinted that the Bank could wind up QE in September, and this pushed the euro higher in recent weeks. If ECB President Mario Draghi hints at an end to QE, the euro will likely gain ground. Draghi may prefer to keep a low profile until March, after policymakers have had a chance to review updated economic forecasts.

Global stock markets are in green territory on Tuesday, as investors cheered the end of the US government shutdown, which started on Friday night. On Monday, the Senate voted 266-150 to extend funding until February 8. This stopgap measure will enable the government to provide services during that time, but the parties will have to hammer out a longer-term agreement. The Democrats held up a funding bill last week, in order to force the Republicans to the table over illegal immigration. The Republicans have promised to hold a vote on this issue, but many Democratic lawmakers remain skeptical that President Trump and the Republicans will deal in good faith over immigration.

Economic Calendar

Tuesday (January 23)

- 5:00 German ZEW Economic Sentiment. Estimate 17.8. Actual 20.4

- 5:00 Eurozone ZEW Economic Sentiment. Estimate 29.7. Actual 31.8

- All Day – ECOFIN Meetings

- 10:00 Eurozone Consumer Confidence. Estimate 1

Wednesday (January 24)

- 3:30 German Flash Manufacturing PMI. Estimate 63.2

- 3:30 German Flash Services PMI. Estimate 55.6

- 4:90 Eurozone Flash Manufacturing PMI. Estimate 60.4

- 4:00 Eurozone Flash Services PMI. Estimate 56.5

*All release times are GMT

*Key events are in bold

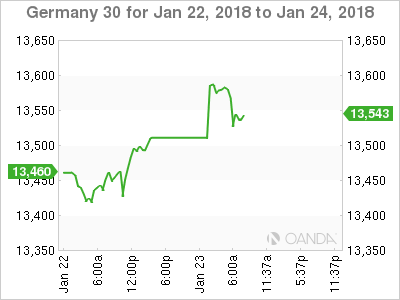

DAX, Tuesday, January 23 at 7:05 EDT

Open: 13,584.50 High: 13,598.50 Low: 13,518.50 Close: 13,545.50