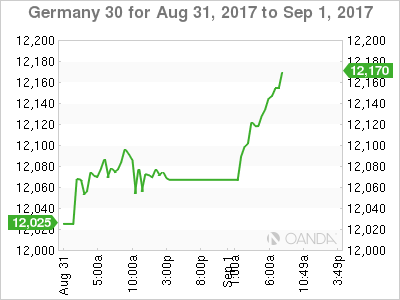

The DAX index has posted gains in the Friday session. The DAX is currently trading at 12,152.50, up 0.80% on the day. On the release front, European manufacturing reports were as expected. German Manufacturing PMI improved to 59.3, close to the forecast of 59.4 points. The Eurozone Manufacturing PMI showed a similar trend, rising to 57.4, which matched the estimate. In the US, the focus will be on employment data, led by nonfarm payrolls.

The robust German economy has led the way for a stronger eurozone economy, and there was further good news on Friday, as German and eurozone manufacturing PMIs improved in August and indicated strong expansion. Manufacturing was buoyed by domestic demand as well as a stronger global economy which has increased demand for German and European exports. The sharp readings underscore improvement in the eurozone economy, which has led to speculation that the ECB may taper its ultra-accommodative monetary policy. The bank’s assets purchases program is scheduled to end in December, and analysts expect the ECB to withdraw stimulus in early 2018. Still, the ECB has not provided much guidance as to its plans. ECB President Mario Draghi opted not to discuss monetary policy at last week’s meeting of central bankers at Jackson Hole, which has increased speculation that the issue will be addressed at the bank’s policy meeting on September 7. In June, Draghi spoke in positive terms about the eurozone economy, and the markets seized on his comments and sent the euro soaring. Given this kind of market behavior, any comments about monetary policy at next week’s policy meeting could have a strong impact on the euro.

After a sparkling US GDP report on Wednesday, will nonfarm payrolls follow suit? The markets are braced for a weak reading, with nonfarm payrolls forecast to weaken to 180 thousand. If these key reports don’t beat expectations, the US dollar could lose ground. The markets will be keeping a close eye on US wage growth numbers, as a weak reading would signify that inflation levels remains soft, and could lower the likelihood of a rate hike in December, which is currently below 40%.

Economic Calendar

- 3:15 German Manufacturing PMI. Estimate 59.4. Actual 59.3

- 4:00 Euro zone Final Manufacturing PMI. Estimate 57.4. Actual 57.4

- 8:30 US Nonfarm Employment Change. Estimate 180K

*All release times are EDT

*Key events are in bold

DAX, Friday, September 1 at 7:35 EDT

Open: 12,082.50 High: 12,102.50 Low: 12,047.00 Close: 12,071.00